[ad_1]

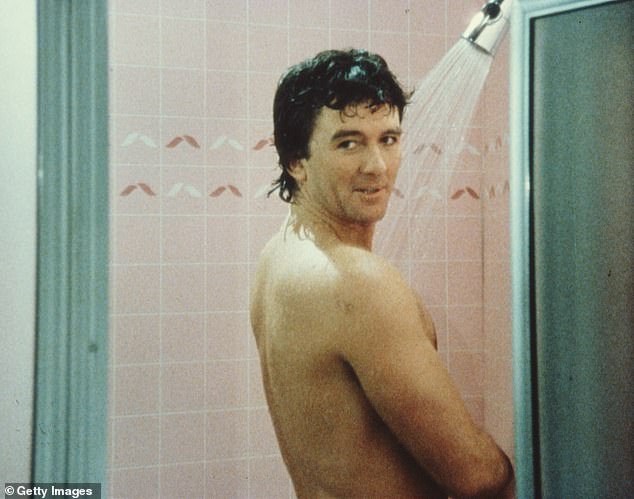

Investors are having a Bobby Ewing moment. As when the previously dead character stepped out of the shower in 80s TV show Dallas and viewers were asked to believe it was all a dream, markets seem willing to suspend their belief too.

The leading US stock market, the S&P 500, is now practically level for the year and above where it stood before Donald Trump unleashed his tariff maelstrom.

That’s quite a turnaround considering the carnage that followed the tariff announcement on 2 April, when stock markets took a tumble, individual shares took a pounding, and the US government bond market staged a revolt.

This matters to UK investors because the US stock market makes up just over 70 per cent of the global stock market and thus represents a big chunk of many people’s pensions and investments.

Dallas viewers were asked to suspend their belief when Patrick Duffy’s character Bobby Ewing came back from the dead in the famous shower scene

In an increasingly concentrated global market, the S&P 500 sets the tone for investor sentiment.

The freakout by investors continued until 9 April, when Trump appeared to blink in his high stakes game of brinkmanship with markets and announced a 90-day pause.

This abrupt reversal sent the S&P 500 rocketing 9.5 per cent in a day and the rally has largely continued since.

It stepped up a gear, as the US and China agreed to cut eye-watering trade war tariffs for 90 days in early May. The S&P 500 is up 5 per cent over the past month and has regained all the lost ground since Trump’s Liberation Day tariff announcement.

This turnaround is remarkable considering the pervasive investor gloom after the tariff announcement.

When Trump arrived for his second term as president, markets were convinced that his bluster and actions would be tempered by an unwillingness to see stocks fall heavily.

They were soon disabused of that.

Markets had started to sink in February, in the build-up to the tariff announcement. Then the erratic execution of the trade levies and Trump’s seeming willingness to ride out a US recession and major market slump, created a real sense of shock.

Musings on sacking Federal Reserve chairman Jerome Powell from his job, which Trump denied as false media claims, didn’t help either.

The S&P 500 fell 18.9 per cent from its mid-February peak to its recent low on 8 April. That’s a hefty correction in anyone’s book.

The resurgence has been striking. Even after a wobble last week, It is now only down 1 per cent this year and only 5 per cent off regaining its peak.

Bloomberg’s John Authers highlighted that the S&P hasn’t rebounded like this after a 15 per cent fall since 1982 and that was before the start of a major bull market.

But should investors see this as a hopeful sign or beware a potential bull trap being laid?

Donald Trump’s Liberation Day tariffs rocked markets but although a 90 day pause and winding down of tension with China may be in place, the trouble won’t go away

From US exceptionalism to US erraticism

It’s certainly hard to swallow the idea that everything’s fine.

Even after our UK-US trade deal, we still have considerably higher tariffs than at the start of the year. Most of the world has much greater trade barriers with the US than previously, and China and the US have stepped back but that is to tariffs of 30 per cent coming into America and 10 per cent into China.

Trump has made it abundantly clear that he intends to upend the established world financial order.

The replacement of US exceptionalism with US erraticism was highlighted last week, when Trump suddenly declared 50 per cent tariffs on the EU, which within days he decided to pause until July.

Meanwhile, the US tech giants and companies that have bought favour with Trump’s government by announcing huge investments in offices, plants and jobs in the US will find that costly.

These companies had chosen to make products or source materials from overseas for a reason, it was cheaper – and perhaps considered better. Reshoring will be expensive.

They will remain hugely profitable but possibly find earnings grow slower, which is awkward if your shares are priced for perfection.

It’s no wonder that some investors are questioning the previously extremely profitable trade of just backing the US and looking at where else to put some of their money.

This has an impact for investors who have taken the sensible passive index investing approach too.

The US stock market makes up a huge 71% of the MSCI World index

The fundamental core of index investing is a global stock market tracker, but the way these are structured, combined with the astonishing growth of the American stock market, has increasingly made them a bet on US shares.

The MSCI World Index, which invests in large and mid-cap companies in 23 different countries, doesn’t look so broad and global when you consider that 71 per cent of it is invested in the US.

Three of its top ten constituents, Apple, Microsoft and Nvidia, are all individually larger that the UK’s 3.84 per cent weight in the index. And less you think that’s because our stock market is a minnow, the UK is the third largest country holding, after the US and Japan’s 5.65 per cent weighting.

Good news for the UK stock market?

The market mayhem might have paused for now, but this desire to look elsewhere is likely to continue.

Fund managers and professional investors that I have spoken to in recent weeks point to the UK as a beneficiary of this, along with Europe and maybe Japan.

The FTSE 100 is already outperforming the S&P 500 and there is a suggestion that Britain’s blue-chip index and its often undervalued medium and smaller companies could see a sustained benefit.

The suggestion isn’t that investors will abandon the US altogether, but that even if just some of the cash that has flooded into US stocks is diverted into UK shares instead, we could see a real benefit.

Apple’s £2.8 trillion market capitalisation alone is bigger than the entire UK stock market’s combined £2.4 trillion value.

You can see how a little money flowing out of the US stock market and its titans could make a big difference elsewhere.

Perhaps it could even lead to the UK stock market finally getting its revival – it’s certainly a more likely source of money flowing into British shares than daft ideas to cut the cash Isa limit.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .