[ad_1]

Diversification is one of the keys to successful investing. By investing in a range of shares and investment funds – and in other asset classes such as bonds and infrastructure – you spread your risk without necessarily compromising your ability to generate long-term returns.

In terms of fixed income, strategic bond funds offer an extra layer of diversification, because they scrutinise markets across the world in search of the best bonds to invest in.

This results in their portfolios comprising both government bonds and corporate bonds issued by businesses to raise funds for reasons such as expansion, take-overs or product development.

Although some funds in this specialist sector are long-established, with records going back 15 years or more, Nedgroup Global Strategic Bond is a relative newcomer.

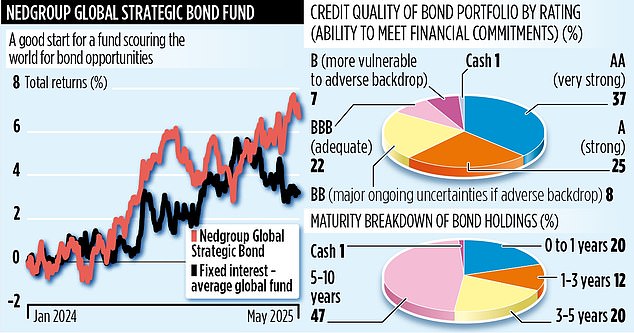

The fund, run by Alex Ralph and David Roberts, launched in January last year and returns of just under 7 per cent have been respectable.

The average for its peer group in the same period has been just over 3 per cent. While the fund has assets of just below £80m, Ralph says interest from discretionary wealth managers and investors with portfolios on online platforms is rising.

‘What we’re offering,’ he adds, ‘is a core bond fund. It is diversified through geography and bond mix, and it provides a bit of ballast in an investor’s overall portfolio.’

The fund is certainly broadly invested, with a 35 per cent allocation to bonds issued by the governments of the UK, Germany, and the United States. Its top ten holdings are all government bonds from these three countries.

Apart from a small amount of cash, the rest of the fund is in bonds issued by some of the world’s best-known businesses.

In the UK, it has stakes in corporate bonds from the likes of AstraZeneca, Barclays, British Telecom, National Grid, Scottish Hydro, SSE, Telefonica and Vodafone.

International exposure is through companies such as JP Morgan and Mars in the US – and Italian green energy giant Enel.Ralph says the fund is more defensive than aggressive in nature, a fact demonstrated by its heavy exposure to ‘investment’ rather than ‘speculative’ grade bonds.

In general terms, ‘A’-rated and triple ‘B’ bonds are classified as investment grade. This means the businesses offering them are robust financially, so the bonds are more likely to deliver on promises to holders. Speculative bonds pay higher income, but the risk of a default is higher.

Currently, the Nedgroup fund is more than 80 per cent-invested in investment grade bonds. An expected economic slowdown in the US, caused by Donald Trump’s vacillating stance on tariffs, has resulted in Ralph and Roberts tickling up exposure to bonds from utility and telecom firms.

‘These businesses tend to be domestically focused, so tariffs aren’t a major issue,’ says Ralph.

The fund is sold worldwide – Nedgroup is a South African company with offices in London – and a sterling share class is available for UK investors.

Annual fund charges total 0.65 per cent. Dividends are paid quarterly. Similar ‘strategic’ bond funds with longer track records are plentiful.

Scrutineer Fund Calibre gives ‘elite’ labels to ten of these funds, including those run by the likes of Aegon (Strategic Bond), Invesco (Tactical Bond) and M&G (Optimal Income).

Visit fundcalibre.com/elite-funds for more details.

Although the Nedgroup fund is still relatively young, Ralph and Roberts have plenty of experience, running similar vehicles at Artemis (Ralph) and Aegon and Liontrust (Roberts).

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .