[ad_1]

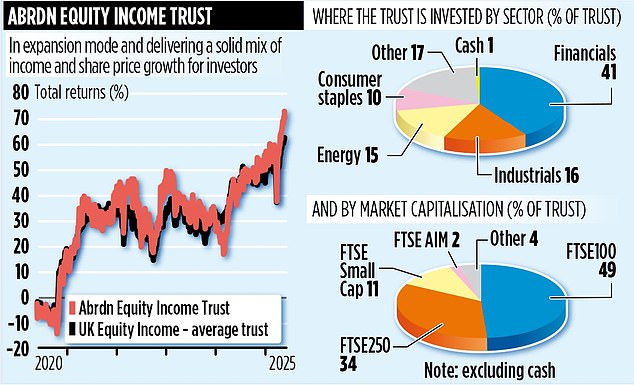

Few investment trusts are currently in expansion mode, but Abrdn Equity Income is quite an exception.

On the back of some good returns over the past year, the £170 million trust recently issued 175,000 new shares, raising more than £600,000 in the process – money that was gleefully invested in the UK stock market by manager Thomas Moore.

For Moore, who has been at the trust’s helm for more than 13 years, the successful share issue reflects the fact that investors are ‘looking at the UK stock market again’.

‘As a manager, I’m licking my lips,’ he says. ‘The market is in a sweet spot after years of shrinkage in the cohort of investors prepared to buy UK shares.’

He also believes the trust’s mix of high dividend yield (6.4 per cent per annum) and strong share price gains is proving a compelling choice for many investors.

‘We’re delivering a winning formula, comprising a mix of income and capital growth,’ he adds.

The numbers are appealing. Over the past year, the London-listed trust has generated a total return of 24.2 per cent – in excess of both the FTSE 100 (up 8.5 per cent) and the broader FTSE All-Share Index (7.9 per cent). It has also outperformed the average for its UK equity income peer group of 13.6 per cent.

Alongside this, the trust has a 24-year track record of annual dividend growth.

In the last financial year (to the end of September), it paid quarterly dividends totalling 22.9p a share. So far this year it has declared two dividends, each worth 5.7p a share, with the second payment to be made at the end of this month. To put these payments into perspective, the shares are worth around £3.56.

To complete the rather glossy picture, the shares trade at a small premium to the value of the trust’s assets – the shares of most investment trusts stand at a discount to the value of their underlying assets.

Moore is very much an investor who goes in search of cheap UK shares which provide an attractive dividend yield.

‘I’m not worried about buying cheap shares,’ he says. ‘I stay close to the companies we invest in.’

He says there are plenty of good value companies around, ‘throwing off lots of cash’ which can be used in part to fund dividends – or share buy-backs.

It means the trust’s 50-strong portfolio comprises the likes of investment house M&G, insurer L&G and tobacco giant British American Tobacco with compelling yields – 7.9, 8.5 and 6.6 per cent respectively.

Moore says that at the moment he is able to find attractively priced shares with good yields from right across the UK stock market – among both the FTSE 100 as well as smaller companies.

One of his favourite portfolio stocks is airline Easyjet. Although the dividend yield is modest at just over 2 per cent, he is convinced that the company has the potential to double its earnings.

Once the company’s investment in new and bigger planes is complete, in the process boosting earnings, he believes that more money will be diverted towards paying dividends and completing share buy-backs. ‘Both historically and when compared to rivals, such as Ryanair, its shares look cheap,’ adds Moore.

Although Moore is pleased with the way the trust is performing, he is ‘not counting his chickens’.

He says: ‘For now we’re in a good spot, but we have to be mindful of the challenging macroeconomic backdrop and the potential for disruption in the bond markets.’

The trust’s stock market identification number is 0603959 and the ticker AEI. Annual charges total 0.86 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .