[ad_1]

Titanium doesn’t have the same buzz as lithium or rare earths, but its importance is climbing fast.

Lightweight, strong, and corrosion-resistant, it’s essential in everything from aerospace to medical implants, and increasingly, it’s becoming a metal of strategic significance.

The aerospace sector remains the heavyweight buyer. Titanium alloys are a go-to material for jet engines and airframes, offering the strength of steel at nearly half the weight.

As commercial aviation recovers and global defence budgets swell, demand here is set to rise. But titanium’s uses go well beyond the skies.

In medicine, titanium is the metal of choice for implants. It doesn’t react with the human body, making it ideal for surgical applications ranging from joint replacements to dental implants.

Industrial uses

Meanwhile, industrial uses continue in heat exchangers, offshore equipment, and high-performance parts that need to resist corrosion or operate at high temperatures.

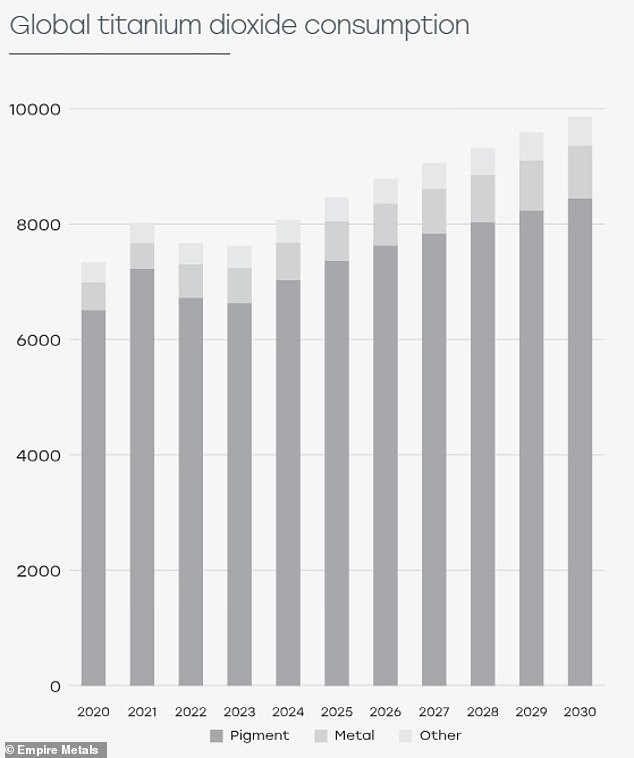

Then there’s pigment-grade titanium dioxide (TiO₂), a compound used in paints, plastics and cosmetics. That market is less flashy but highly stable, and it offers cash flow potential for producers with the right purity levels.

The real shift today, however, is geopolitical.

Titanium demand is expected to continue to rise

Titanium sponge, the base material for alloys, has traditionally come from Russia and China.

Sanctions and growing trade tensions are pushing governments and manufacturers to secure alternative sources. The US, UK, and EU have all flagged titanium as a critical raw material that needs a more resilient supply chain.

Energy transition

At the same time, the energy transition is giving titanium a new role. Offshore wind, hydrogen production, and geothermal energy all use titanium components to withstand tough environments. It’s not as central to the green economy as copper or lithium, but its durability makes it hard to replace.

For investors, that all adds up to a market with growing demand and renewed strategic value. High-purity titanium projects, especially those outside China and Russia, are now in the spotlight.

That’s why developments like Empire Metals‘ Pitfield project, which just reported lab-scale results showing 99.25 per cent TiO₂ purity, are attracting attention.

That level of refinement is big news. It opens the door to higher-value uses, including titanium sponge for aerospace alloys or high-grade pigment production.

No secret sauce

The key? Empire’s processing team, working with ALS labs in Perth, used well-established methods: beneficiation, acid baking, leaching, and purification, all done on a bulk sample taken from near-surface drill cores.

Crucially, it didn’t need to ‘seed’ the process with external TiO2 this time, a sign of improved chemistry and recovery. This could make the production route more scalable and cost-effective down the line.

Next steps include repeating the process on a 70-tonne bulk sample and shipping material to potential customers. With a £7million cash buffer and a maiden mineral resource estimate due soon, Empire is shifting gears from exploration to development.

Panmure Liberum sees this as a pivotal milestone as Empire works to define the scale and economics of Pitfield.

Pivotal milestone

The initial resource is expected to confirm a vast titanium system, with earlier estimates pegging the exploration target at up to 32 billion tonnes at grades of 4.5 to 5.5 per cent.

If Pitfield can deliver consistent, high-purity TiO2 using conventional, scalable techniques, it could become a rare western supply of titanium at a time when geopolitical tensions are encouraging buyers to diversify away from Chinese and Russian sources.

For now, Empire is flying under the radar, but these results show it could be developing something far more significant than your average junior mining project. It’s worth watching.

For all the breaking small- and mid-cap news go to www.proactiveinvestors.co.uk

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .