The fast-mounting tensions in the Middle East are fuelling the ascent of gold.

The price hit $3,389 an ounce this week – 30 per cent higher than at the start of the year, and 185 per cent above its level of a decade ago.

The metal is being called ‘the new dollar’ since it is supplanting the US currency as the place to seek shelter in tough times.

This new status suggests that maybe you should make some room for gold in your portfolio, particularly if you are apprehensive about the outlook for inflation.

Meanwhile, even if you have already joined the gold rush of 2025, it is worth taking a look at the other precious metals whose values are being propelled by the view that gold is the safe haven of our era.

The price of silver is up by 29 per cent since January, while platinum has soared by 39 per cent to $1,312. Silver is used in batteries and solar panels. The demand from platinum is coming from the jewellery industry, particularly in China. This metal is also needed for the catalytic converters on hybrid and petrol cars.

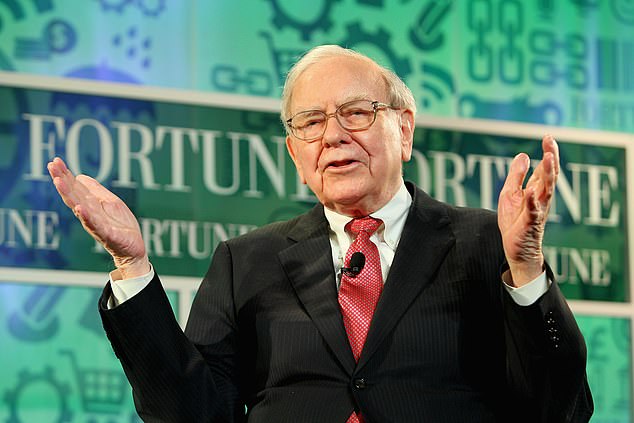

Sound advice: As the legendary US investor Warren Buffett has said, gold ‘doesn’t do anything but sit there and look at you’

Precious metals are having a moment. But will it turn into a long-term trend? Here’s what you need to know.

WHAT’S NEXT FOR THE GOLD PRICE?

In the short-term, any worsening of the hostilities between Israel and Iran may spur further gold price rises.

Goldman Sachs expects the price to increase to $3,700 by Christmas, and to $4,000 by the summer of 2026. Citigroup is almost a lone pessimist, forecasting a retreat to about $2,600 by Christmas next year.

By contrast, the arch-optimists see bullion hitting $5,000 by the end of the decade.

Earlier in the year, the fears that Donald Trump would impose tariffs on the import of gold to the US gave the price a fillip. This did not materialise.

But a gold spending spree at central banks is now fuelling the metal’s ascent. These institutions, whose key responsibility is to ensure the financial stability of their nation’s, are buying 80 metric tonnes of gold a month which is worth about $8.5billion.

US dollars still make up about 46 per cent of these banks’ reserves, but gold accounts for about 20 per cent, having overtaken the euro, as data released this month reveals.

Secrecy covers which central banks are buying. But it is clear that some nations, such as China, are playing catch up.

China’s holdings may be at the highest ever, but just 10 per cent of its reserves are in gold, by contrast with France, German, Italy and the US where the share is closer to 70 per cent. In the UK, the percentage is under 20 per cent, following the sale by then Chancellor Gordon Brown in 1999 of about half of the stockpile stashed in the Bank of England. At the time, the price was about $298.

Through its gold purchases, China is seeking to bolster the credibility of its currency, the yuan. But, like other nations, it is engaged in ‘de-dollarisation’ that is lessening dependence on the US currency.

In some emerging market nations, this shift is being driven by anti-American sentiment. But it is also a policy prompted by pragmatism, with fears that there could be more ‘weaponisation’ of the dollar.

US sanctions imposed on Russia following the invasion of Ukraine and its exclusion from the Swift international payment system rendered that country’s dollar reserves worthless.

Central banks view moving more into gold as way to swerve such a fate. They are also alarmed by the size of US debts.

But this anxiety has yet to reach a pitch that would precipitate a frenzied investment in gold. James Luke of asset manager Schroders says: ‘The fiscal frog continues to boil slowly, for now.’

This is a reference to the adage that people tend to wake up too late to the progressively increasing risks of a situation in the same way that a hapless frog seems not to be conscious that the temperature of water is becoming ever hotter.

Even if there is no sudden upward surge, central banks seem set to keep going for gold, limiting the amount available for trading and so putting a floor under price falls. Lina Thomas of investment bank Goldman Sachs says: ‘The long-run bull story for gold is that central banks are buying large amounts of it. We expect that to continue for at least another three years.’

SHOULD YOU GO FOR GOLD?

Despite the predictions that the gold price will remain strong, some investors will never get into the metal because it does not provide an income – and because they regard it as fundamentally uninteresting.

As the legendary US investor Warren Buffett has said, gold ‘doesn’t do anything but sit there and look at you’.

Even if you are unconcerned by the lack of a yield and also of excitement, it would still be unwise to commit more than 5pc of your portfolio to the metal.

You also need to ponder your strategy. If you are drawn to the look of gold, with its beguiling lustre, you may be interested in acquiring a bar, a coin or an ingot.

A one kilogramme gold bar will set you back about £82,000 at Sharps Pixley, the bullion dealer in St James’s Street, London, although smaller, much less expensive versions are available. The Royal Mint has also options for most budgets. Its website is a mine of information on every aspect of gold. But do not overlook the practical issues such as storage – in a secure vault.

Holding physical gold through low-cost exchange traded commodity (ETC) fund is simpler, if more prosaic. These funds track the price of the metal by owning bullion, which is safely stashed in vaults.

The investor platform best-buy options include iShares Physical Gold, which opts for responsibly-sourced gold.

This column highlighted this fund in February, when the metal’s price was about $2,900, and it became my choice for a first foray into gold.

For me, gold jewellery is an adornment, rather than an investment. Funds that hold gold mining shares are a more complex proposition. The profits of these companies gain an extra boost from upward moves in the gold price since their overheads are fixed.

But they face other challenges, like the cost of borrowing and possible political intervention.

For example, the authorities in Mali have taken control of Barrick Gold’s mine in that country following a dispute. The mine accounts for 14 per cent of the output of Barrick, a Canadian group.

If you are prepared for such eventualities, the gold mining company funds that appear on the platforms’ best buy lists include BlackRock World Mining and Ninety One Global Gold.

Ninety One Global Gold has stakes in the big mining names like Newmont, Northern Star, Alamos Gold and AngloGold Ashanti. The $64.81billion Colorado-based Newmont is the world’s largest name in its field.

As always, it is wise to check whether you already have exposure to gold through funds and trusts that aim for capital protection. Personal Assets, Ruffer and Troy Trojan all have a slug of gold.

If you are ready for an adventure in the world of metals, Ben Yearsley of Fairview Investing suggests Amati Strategic Metals which invests in gold, silver platinum, but also copper, manganese and rare earth metals.

The fund’s top holding is Fresnillo, the Mexican gold and silver mining group whose shares have jumped by 117 per cent since January. This rise may not continue. But it is a sign that this is a sector which you cannot afford to ignore.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .