[ad_1]

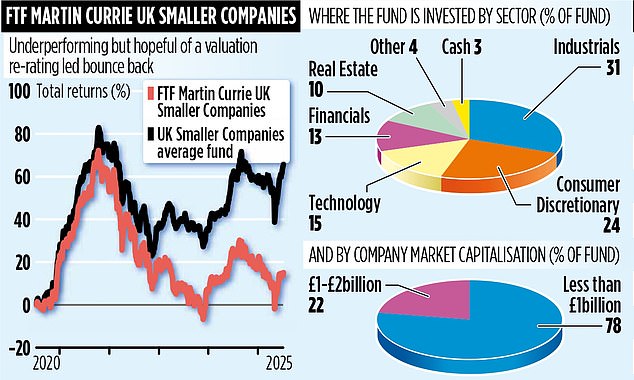

The past four years have been frustrating for investors in FTF Martin Currie UK Smaller Companies. Since the middle of 2021 the fund’s share price has, for the most part, drifted downwards.

Yet lead manager Dan Green is convinced there is sunshine on the horizon that will lead to a significant rerating of the investment universe from where he picks stocks.

He believes the undervaluation of the companies he targets – ‘quality’ businesses with average market capitalisations of about £600 million – cannot go on for ever.

At some stage, as UK interest rates head further downwards and institutional money spots the potential of UK smaller companies, he says the ‘valuation gap’ will close, reaping rewards for investors. Patience, he argues, is the name of the game.

Existing investors will hope he is right. Over the past one, three and five years, the £100 million fund has performed poorly, both in absolute and relative terms.

Over one and three years, it has made respective losses of 8.6 and 8.5 per cent – only a handful of UK smaller company funds have done worse. Over five years it has registered positive returns of 11.5 per cent, though its relative performance is again poor.

Green says the fund’s focus on the smaller end of the smaller firms’ universe has seen returns hampered by a ‘valuation squeeze’.

He explains: ‘If you look at companies with market capitalisations of below £1 billion, 35 per cent of them have share prices which trade at below ten times forward earnings – a historically low figure. Above £1 billion, the equivalent percentage is 17 per cent.

‘In other words, there are more undervalued companies in the slice of the market I concentrate on – below £1 billion. That suggests large upside potential.’

More than three-quarters of the fund’s holdings have market capitalisations below £1billion.

Though Green says there are about 1,000 companies the fund could invest in, most go by the wayside. Those that do not make profits are ignored, as are stocks in cyclical sectors – oil and gas, mining, energy, and banks. ‘What we are after,’ he says, ‘are companies which have the right quality, are the right size and possess the right characteristics. We like businesses which operate in a growing market or dominate one.

‘We also prefer cash generative businesses which are capital light.’

The fund’s biggest holding is Alpha Group International, which manages foreign exchange risk for corporations. It listed on the Alternative Investment Market (AIM) in 2017 and is now a constituent of the FTSE250 Index. ‘We’ve been a shareholder since 2020,’ says Green. ‘We bought shares at a price of £9.10 and they now trade just below £30. With double-digit revenue every year since 2017, it remains a compelling investment.’

Though Alpha’s market capitalisation is now £1.3 billion, Green likes to run with his winners.

He adds: ‘You don’t want to pull out the roses and then be left to water the weeds.’

Like many UK smaller companies, the fund has benefited in the past two years from companies being taken over. Green believes this will continue as valuations remain attractive to predators.

The fund’s exposure to AIM-listed stocks has fallen from 50 per cent to 30 per cent in the past two years due to an undermining of the market by Labour curtailing tax reliefs available to investors.

Green does not rule out further tax changes harming the market further. He says: ‘The fund has gone through a challenging period but the quality of the businesses will come through, I’m sure of that.’

The annual fund charges total 0.83 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .