[ad_1]

What is the right number of funds to hold in your pension or stocks and shares Isa? It’s a question many DIY investors ask ourselves, especially after a buying spree.

It is, after all, easy to get carried away, enticed by a racy growth story or an investment that has foundered and may bounce back.

Picking investments is a fascinating hobby, fellow hobbyists would probably agree. It is the art of understanding the world better than the next investor – the trends, the risks, the growth opportunities – and then making better returns as a result.

But dangers lurk. We all have biases in our decision making that can lead to questionable investment choices. And those decisions can build up into an accumulation of decisions that manifest themselves in holding lots and lots of funds.

So, what is the right amount to hold?

For my part, I have five funds per £100,000 of money in my pension.

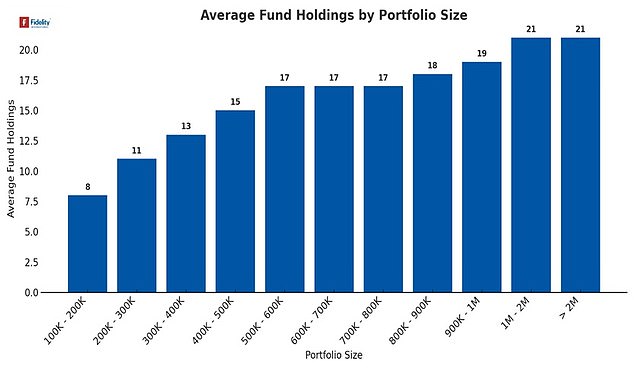

But perhaps it’s more beneficial to use a bigger pool of data. Fidelity has more than 550,000 DIY investors in the UK, offering a huge pool, and its average numbers for various tiers of wealth offer a benchmark.

How many funds do investors hold in their pension or Isa? Fidelity looked at 550,000 portfolios of different sizes to find out

How many is too many?

Those with portfolios of between £100,000 and £200,000 have an average of eight fund holdings, as the chart above shows.

Those with larger portfolios seem to resist the opportunity to keep buying more, with the number plateauing at 17 from £500,000 portfolio sizes.

Is that too many funds or too few? It’s difficult to give a firm answer.

So much depends on what you want to achieve and the risks you are willing to stomach.

These factors will dictate the investment mix included in a portfolio.

For example, someone investing for at least 10 years and comfortable with volatility might want to go 100 per cent into stock market funds; someone retiring in five years and planning to withdraw money may want a portion of the portfolio in bonds, which tend to move counter to stock markets, although not always.

Investors may also want other diversifying assets such as real estate or commodities. A financial adviser can help work out what you need.

Even within stock markets, investors may want a bent towards a particular region or country.

So rather than following the typical allocation that a global tracker fund would give (67 per cent US, 13 per cent European and 4 per cent UK for the Legal & General Global Equity Index, for example) they may want more, or less, in each. An investor may want more technology exposure, or to back renewable energy.

This can be achieved by buying regional funds and specialist funds – and this is when excessive fund buying can happen.

Here, I’ve set out four questions to ask yourself.

How many funds can you really keep an eye on? asks Andrew Oxlade

1: How many investments can you safely monitor?

Selecting your own shares requires some homework.

With funds, a manager does that for you. But the fund investor must also keep an eye on each fund, especially for the exit of a star manager.

And managers can also have fallow spells.

It then requires a call on whether to hold until their mojo returns, or to sell. Either way, holding actively managed funds requires more monitoring.

Do you have the time to do that with 20 active funds?

Of course, funds that aim to track an index – so-called passive funds – require less attention.

Many of the investment platforms offer deeply researched lists on funds, which can be helpful. For ours – the Select 50 – the research and selections are undertaken by Fundhouse, an independent funds rating agency.

2: Do you have hidden overlaps?

Commonly, an investor may have a core holding of a global stock market tracker fund, with other funds that add a flavour of particular countries or regions they want to back.

And within that part of the portfolio, it’s just possible that the engaged investor has had their head turned by funds of a similar ilk – perhaps two high income funds that might both hold British American Tobacco. This may not be a problem but it is good to know where you do hold overlaps.

Some investment platforms have ‘X-ray’ tools that enable you to see these overlaps. They can show you the percentage of your portfolio you have in each company.

I was alarmed earlier this year by my exposure to Nvidia across many funds. This included index tracking funds in the core and active funds on the periphery.

3: Is it more expensive to be a multiple fund holder?

DIY investors face two primary costs – the charges on the fund and the charges applied by the fund platform for holding it for you.

An actively managed fund will commonly cost around 0.75% or £75 a year per £1,000 of investment; passive funds cost a lot less.

Platform percentages vary considerably and so do pricing structures.

This is important to the thinking on the number of funds to hold.

Some platforms charge a dealing fee to buy and sell funds, normally as a pay-off for lower ongoing costs. However, this can rack up if you hold a lot of funds and like to tinker.

And with investment trusts, the cousins of funds that trade as listed companies, there is nearly always a fee for buying and selling.

It is worth applying this lens to your thinking.

Small allocations to many funds may not significantly influence overall portfolio performance and may add unnecessary costs.

4: Would you be better with a ‘simple life’ option?

It kind of defeats the point of being a DIY investor, but you could stick with a single fund that is a ready-made portfolio. DIY-ing isn’t for everyone, after all.

Such funds can offer some diversification, which is key, by holding a mix of assets. If one flags, another may pick up the baton: when share prices fall, bond prices should rise, or that’s the theory. A popular allocation is to divide 60% in shares and 40% in bonds, or 80/20 for those willing to take more risk.

You can do this cheaply and easily with a single fund. The Vanguard LifeStrategy fund range is an example, with 80/20 and 60/40 funds among others. The simplicity of such funds, which track markets rather than actively selecting investments, has made them popular in recent years. There are also lots of actively managed funds that aim to do this and beat the index.

Will I reduce my fund holdings?

In short, yes. Or at the very least I’ll be mindful of the very questions I’ve raised and that will help limit expansion from where I’m at. But ultimately, managing a DIY portfolio is an enjoyable hobby – and that enjoyment is something I wouldn’t want to diminish.

SIPPS: INVEST TO BUILD YOUR PENSION

AJ Bell

AJ Bell

0.25% account fee. Full range of investments

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing, 40% off account fees

Interactive Investor

Interactive Investor

From £5.99 per month, £100 of free trades

InvestEngine

InvestEngine

Fee-free ETF investing, £100 welcome bonus

Prosper

Prosper

No account fee and 30 ETF fees refunded

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .