[ad_1]

The UK stock market represents a safe port in stormy waters. That is the view of Ben Needham, who manages the Ninety One UK Equity Income fund.

Needham has run the £66 million fund for almost six years. He says that while he would like to see the Government promote a more pro-business agenda, he believes UK equities are currently in something of a sweet spot.

‘UK investing is fun at the moment. There are lots of mispriced assets [companies] out there which mean you can buy cheaply and give yourself the chance to make some attractive long-term returns,’ Needham says.

Given the payout ratio (via dividends and share buybacks) from companies that make up the FTSE All-Share Index is currently around 6 per cent per annum, he says investment managers don’t have to do much to get a decent overall return of 10 per cent plus.

The payout, he adds, provides investors with invaluable ‘downside protection’.

The fund currently comprises 34 holdings, all constituents of the FTSE All-Share Index.

Stocks selected for the portfolio have three hurdles they need to clear. First, the businesses must prove they are using their capital to generate profits better than competitors.

They also must demonstrate a willingness to continually reinvest in their business operations, thereby enhancing their competitive position. ‘If businesses don’t reinvest, they won’t grow. If companies spend more, the stock market sometimes won’t like it, but our view is that it is fuelling sustainability,’ says Needham.

The final hurdle is a firm’s valuation. The manager won’t buy a company that ticks the previous two boxes unless they represent ‘good value’. He will also sell-down a holding if the share price is getting toppy. Needham says the application of these hurdles means there are no more than 80 stocks the fund can invest in.

Among the fund’s top 10 holdings is cross-border money transfer business Wise. Needham bought into the company last summer after its share price dipped in response to news that it was cutting fees for customers.

‘Wise is a disruptor,’ he adds. ‘It brought down costs for people and businesses doing international money transfers. It also launched a platform for third parties, which they can offer to their own customers to transfer money globally.’

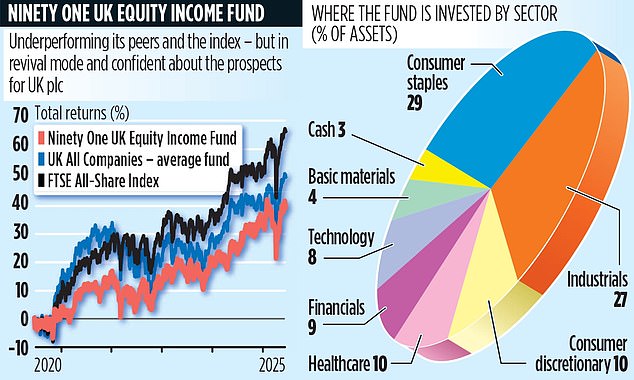

When judged against the FTSE All-Share Index, the fund has underperformed over the past five and three years – and outperformed over the past year. A lot of the relative underperformance is down to the fund struggling in the aftermath of the 2020 lockdown.

Over the past one, three and five years, returns have been 10.2, 28.7 and 34.2 per cent. The respective figures for the FTSE All-Share Index are 10.1, 33.9 and 66.9 per cent.

The industry’s trade organisation, The Investment Association, classifies the equity income fund as a ‘UK all companies’ fund. This is because its annual dividend yield of 1.8 per cent is below the yield from the FTSE All-Share Index of 3.6 per cent.

Needham says he will not chase yield. He instead concentrates on delivering a steady increase in income payments – something the fund has achieved since 2020. Income is paid quarterly.

One final point on the economy. Needham says that the fund’s emphasis on ‘quality’ companies – the likes of pub giant JD Wetherspoon and investment platform AJ Bell – should reassure investors.

‘These market leaders will make money, even when the economy is weak,’ he adds.

The fund’s ongoing annual charge is 1.6 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .