[ad_1]

Saving enough for an affordable retirement might seem to be Against All Odds.

But for those patient enough to stay invested in the stock market, it must feel more like Money For Nothing.

Performed by Phil Collins and Dire Straits, respectively, both songs featured in the Live Aid charity concert held 40 years ago today, which raised more than £100 million in donations for famine relief in Ethiopia.

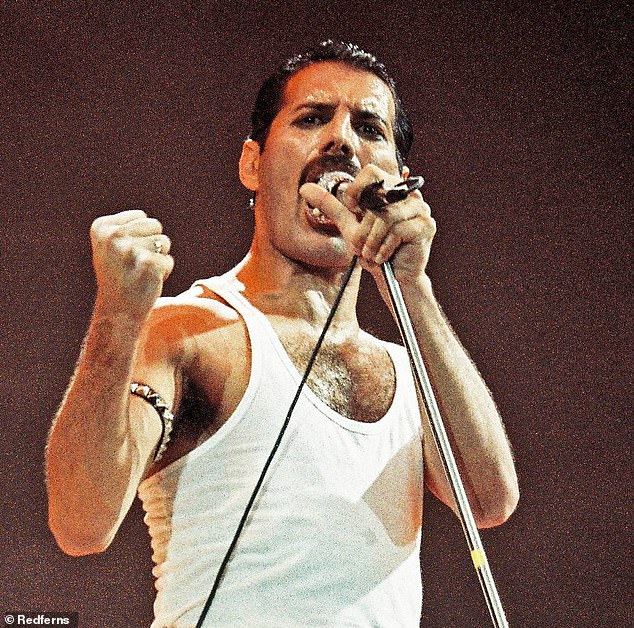

But as they and the likes of Freddie Mercury and George Michael wowed the Wembley crowd – and an estimated 1.5 billion watched on TV worldwide – few would have known that their own financial futures would be transformed if they had the foresight to invest some spare cash wisely.

For anyone who put £100 a month into the global stock market since 1985 could now be sitting on a pot worth more than £22 million, new analysis shows. Crucially, it assumes that up to 85 per cent of the portfolio had been kept in shares for 40 years and the dividends reinvested.

That would have yielded a return of almost 21 per cent a year if you kept ploughing money into the global stock market through thick and thin.

Kind of magic: As the likes of Freddie Mercury performed at Live Aid, few would have known that their own financial futures would be transformed if they had invested spare cash wisely

Even patriotic savers who bought a low-cost fund tracking the share price movements of UK equities would have seen their nest egg swell to almost £2 million, according to financial adviser Continuum.

Stashing the same amount of money under a mattress would have yielded just £48,000 – or around £62,000 if the sum had been dripped into a typical bank savings account or cash ISA – meaning that you would have lost money in real terms after taking account of inflation.

The findings underline the benefits of investing in shares for the long term – and of not trying to trade in and out of the stock market’s many ups and downs.

‘Taking some risk is likely to produce better results than cash over time, and the data backs this up,’ said Continuum’s Richard Watkins. ‘If you want a comfortable later life, you must start saving as soon as possible, keep at it and diversify.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .