[ad_1]

Britain’s largest corporate undertaker has become the latest firm to find itself besieged by offers to hold takeover talks as its boss said the London stock market has become a ‘hunting ground’ for private equity sharks.

Begbies Traynor, based in Manchester, is the UK’s largest provider of insolvency and restructuring advice. It is often the one called in when a firm is on the verge of going bust.

Business has been booming as Britain has struggled post-pandemic, with Labour’s tax policies piling even more pressure on companies.

The economy was dealt another blow on Friday when data revealed that UK GDP unexpectedly shrank by 0.1 per cent in May.

Its strong performance means Begbies has now drawn the eye of the same private equity firms buying its London-listed peers, many of whom are being scooped up because they are considered more valuable than their share prices would suggest.

Ric Traynor, the firm’s executive chairman, told The Mail on Sunday that it was increasingly being approached about potential deals.

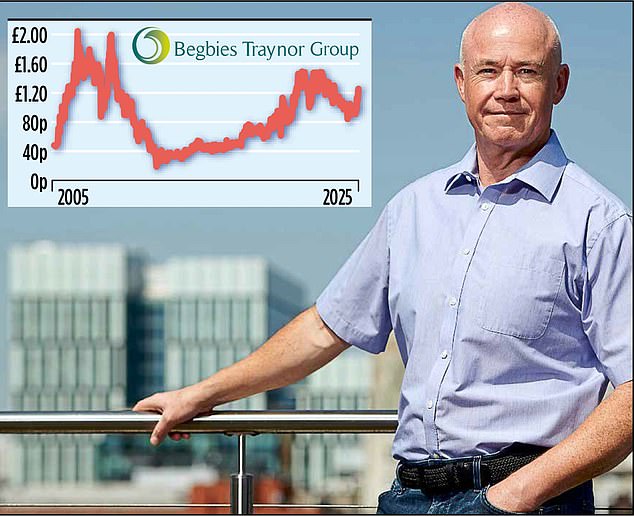

On the market?: Executive chairman Ric Traynor won’t rule out a deal

‘A month doesn’t go by where there isn’t somebody suggesting a conversation, it’s either private equity themselves or some market maker in the middle,’ he said.

Traynor stressed that while the company was not actively seeking out a private equity deal, he did not rule out doing so in the future.

‘Until a couple of years ago, the stock market was working well for us. If we have another couple of years and it still isn’t working for us, that’s when you start to think about whether you can get proper value for shareholders by staying on the market, or if there is a better alternative,’ he said.

While shares in Begbies have risen nearly 35 per cent over the past five years, they are still 15 per cent below their most recent peak of £1.48, which was recorded in late 2022 and is well below the record high of £2.04 reached in May 2006.

‘We’ve seen firms get bought for premiums of 50 per cent or even 100 per cent of their current market value on [London’s junior stock market AIM]… it is a hunting ground for private equity,’ Traynor said.

He added that as the business often worked closely with private equity firms when the companies they owned got into financial difficulty, conversations about a potential deal ‘could easily be initiated if we wanted to’.

The comments came following a strong performance for Begbies, which has seen its profits and share price rise as a slowdown in the UK economy has fuelled demand for its services.

Last week, its shares hit their highest level in nearly two years after its full-year profits almost doubled as more companies were hit by higher costs in the wake of Chancellor Rachel Reeves’s decision to raise National Insurance Contributions and the minimum wage in her Autumn Budget.

Private equity’s courting of London-listed companies is piling further pressure on the UK’s beleaguered stock market, which has suffered a series of high-profile takeover deals in recent years as well as several defections to overseas markets, particularly the US.

Last month, FTSE 250 firm Spectris, which makes high-precision testing equipment and software, was scooped up by US private equity firm Advent International in a £4.4 billion deal.

Another mid-cap group, property investor Warehouse REIT, is also set to be snapped up following a £489 million swoop from private equity giant Blackstone on Friday, snubbing a rival bid from its London-listed rival, Tritax Big Box REIT.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .