[ad_1]

The FTSE 100 defied the gloom taking hold of European markets after President Trump imposed new import levies.

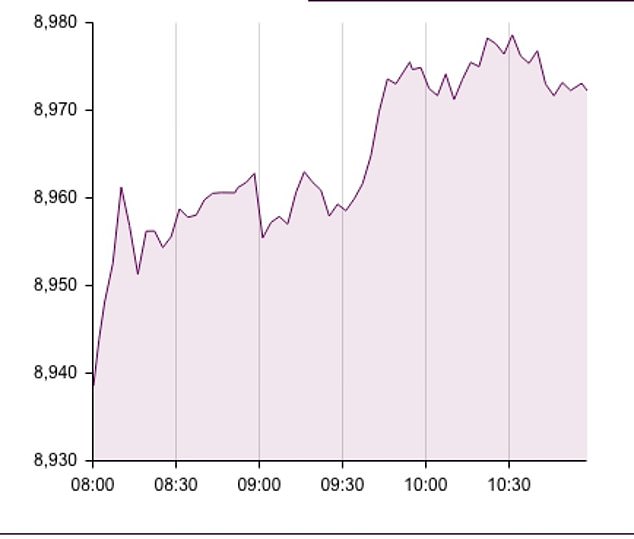

The UK blue-chip index is closing in on a record high of 9,000 points, trading 0.38 per cent higher this morning and is up 8.65 per cent in the year-to-date.

France’s CAC index slipped 0.52 per cent while Germany’s DAX dropped 0.7 per cent after Trump suggested imports from Mexico and the European Union will be hit with levies of 30 per cent from the beginning of next month.

The UK, by contrast, has reached an agreement on a 10 per cent tariff and exemptions for certain industries.

The FTSE 100 reached record highs and is closing in on 9,000 points

‘Unlike their counterparts across the Channel, British companies should be able to operate with greater certainty around trade, and exports may be diverted through the UK,’ says AJ Bell’s investment analyst Dan Coatsworth.

‘This might act as a push for foreign companies to invest in manufacturing and logistics facilities in the UK.’

Mining company Fresnillo was among the top performers on the FTSE this morning, rising 2.82 per cent as silver prices extended their run and reached a 14-year high.

There is also growing optimism that the Bank of England could cut rates faster than initially expected, after comments made by Governor Andrew Bailey over the weekend.

He said policymakers were watching out for the effects of the job market following the increase to employer National Insurance contributions/

Susannah Streeter, head of money and markets, Hargreaves Lansdown said: ‘There is an indication it may be helping to stem hot wage increases, which have been a cause for concern for the Bank.

‘A weakening labour market and a slowing economy could give decision makers the confidence to reduce borrowing costs more rapidly.’

Elsewhere, bitcoin has exceeded $122,000 for the first time as ‘Crypto Week’ in the US gets underway.

Investors may be expecting significant developments, as lawmakers discuss the Digital Asset Market Clarity Act, which aims to establish a regulatory framework, and the Genius Act, which will look at stablecoins.

Bitcoin has also been boosted by strong inflows into Bitcoin ETFs, which were approved last year, and a stronger economic backdrop.

‘The pace of gains in recent weeks reflects not just growing demand, but the growing maturity of bitcoin as an asset class,’ says Josh Gilbert, market analyst at eToro.

‘Institutional adoption is growing, and this is the first real bull market where institutional participation is front and centre.

‘Importantly, retail adoption is still only getting started. Bitcoin as an asset in an investment portfolio is still in its infancy, and that in itself creates a huge opportunity for bitcoin and crypto to flourish over the next decade.

‘This is just the beginning of widespread adoption, seamless integration with traditional finance, and robust regulatory frameworks.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .