[ad_1]

Products featured in this article are independently selected by This is Money’s specialist journalists. If you open an account using links which have an asterisk, This is Money will earn an affiliate commission. We do not allow this to affect our editorial independence.

In our Trading 212 review, find out more about how the investing platform performs and whether it’s right for you.

Trading 212 is a newer investment platform. It’s at the forefront of a crop that have slashed the cost of investing and gained popularity as mobile apps, although you can also use Trading 212 on desktop.

Trading 212 was founded in 2004 but wasn’t incorporated in the UK until 2013. Since then, it’s launched a number of services for UK investors, including fee-free accounts with commission-free trading of stocks and ETFs and a stocks and shares Isa. Trading 212 is available globally and manages £25billion of assets.

We review Trading 212’s fees, look at the features available on the platform, and put its customer service to the test.

> Read our full round-up of the best investment platforms

Trading 212: Who does this investment platform suit?

Good for investors who want low fees

- No account fees, plus zero commission trades.

- Competitive interest rate on uninvested cash.

- Social trading features allow you to follow other investors.

- More limited choice of investments when compared with other platforms.

- You can’t speak to customer service on the phone.

- You can’t open a pension at the moment, although it’s reportedly on the way.

This is Money’s view: Trading 212 is a low-cost platform that has useful features for investors, whether they are beginners or those with some experience already. But it doesn’t currently offer a Sipp and its app takes time to get used to.

> Learn more about Trading 212 and open an account*

You can open these accounts with Trading 212:

- Stocks and shares Isa

- Cash Isa

- General investment account

- CFD trading account

Trading 212 doesn’t currently offer a pension. Read our round-up of the best self-invested personal pensions (Sipps) if you’d like to open a DIY Sipp through an investment platform.

Why you can trust us

This is Money has been covering investing and personal finance since 1999. Read more about how our editorial independence helps make our readers’ lives richer and how we test and review investment platforms.

About our writer: As This is Money’s Money and Consumer Guides writer, Sam is dedicated to helping people find the best financial products for their needs. He’s written for organisations including Evelyn Partners, Simply Business, NerdWallet and the Financial Ombudsman Service. Sam has worked closely with investment managers and analysts, financial planners and consumer finance experts, building his own knowledge about all things money over more than 12 years.

How we tested Trading 212

I opened both a cash and stocks and shares Isa with Trading 212 and have spent several hours testing its features.

I’ve searched for and bought investments, created my own investment pie, delved into Trading 212’s social features and been in touch with its customer service team.

My final review takes all the above into account, along with the platform’s fees, to give my view of who the platform is good for.

You can trade CFDs on Trading 212, but this doesn’t form part of our review. A CFD is a contract for difference – this form of trading allows investors to speculate on a stock’s price movements without owning the underlying asset. At This is Money, we believe CFD trading is highly risky and should be avoided unless you’re experienced and have carried out thorough research.

For this reason, our Trading 212 review focuses solely on the platform as a low-cost way of investing in stocks and shares.

Trading 212’s fees

Trading 212 doesn’t charge an account fee or a fee for holding your investments.

It also doesn’t charge trading commission, making the platform very cost effective.

| Type of fee | Cost |

|---|---|

| Account and custody fees | Free |

| Trading fee | Free |

| Foreign exchange fee | 0.15% |

| Deposits by bank transfer | Free |

| Deposits by card, Google Pay, Apple Pay | Free up to £2,000 cumulative 0.7% after £2,000 cumulative |

| Withdrawals | Free |

This is Money’s view of Trading 212’s fees

Trading 212 can bring the cost of investing in stocks and shares close to zero. For UK investments, you’ll generally only need to pay underlying costs rather than fees charged by the platform itself – for example, ongoing charges within ETFs or stamp duty.

You can keep costs low by making sure you only deposit funds by bank transfer rather than using your card. Trading 212’s foreign exchange fee is lower than eToro’s, which is 0.75 per cent.

Another way Trading 212 helps you keep costs low is by letting you hold money in multiple currencies, which limits the number of times you need to convert your cash.

Essentially it means you don’t need to pay Trading 212’s 0.15 per cent fee for every trade. Conversion is at the interbank rate, which is the rate at which banks buy and sell currencies. 13 currencies are supported, including GBP, EUR, USD and CAD.

Keep in mind this feature’s only available in Trading 212’s Invest account, because an Isa is a UK-specific scheme.

Trading 212 is low cost. But if you’re keen to cut fees even further, Prosper can potentially offer zero-cost investing because it refunds ongoing fees from a select group of index funds.

What is Trading 212’s investment choice like?

Trading 212 offers a good range of investments for DIY investors including more than 13,000 stocks and ETFs from all over the world. You can build a portfolio with:

- Stocks and shares

- Exchange Traded Funds (ETFs)

- Investment trusts

- Model investment pies – your choice of a diversified ready-made portfolio based on your attitude to risk, comprised of ETFs

You can buy fractional shares with Trading 212, which means you don’t have to buy the whole share – you can purchase less than one.

This is useful if you’re looking for an entry point into an investment that has a high share price, such as Alphabet, Apple, or Microsoft.

Trading 212 doesn’t give you the option of investing in funds (open ended investment companies) or individual bonds and gilts.

What is Trading 212’s customer service like?

You can contact Trading 212 by email at info@trading212.com and by using the chat function in the app. It’s not possible to speak to someone from Trading 212 over the phone.

Trading 212 is active online. Its team regularly answers customer questions on its community forum and social media, including Reddit.

Trading 212 claims to offer 24/7 support, but users are sometimes kept waiting for a response during busy periods.

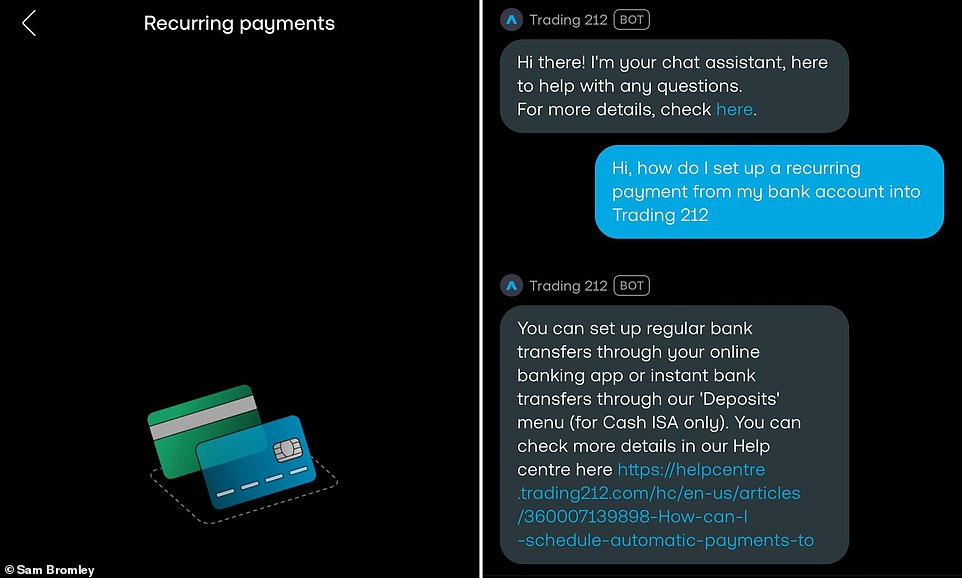

I tested Trading 212’s chat functionality, although I didn’t ultimately ask to speak to a human.

My issue was that I knew I could set up automatic investments into pies using available cash in my account. But Trading 212 doesn’t make it clear how to set up recurring payments from a bank account, even though there’s a spot in the app where recurring payments should appear.

I used Trading 212’s chat function to see whether it could help.

How did Trading 212’s customer service perform?

After you message Trading 212, a chatbot attempts to reply, directing you to content it thinks can help. It suggested I have to set up recurring payments through my bank’s app, rather than on Trading 212 itself.

The link directed me to a page that no longer existed, but the chatbot had done a fairly good job of answering my question.

However, my next issue involved finding Trading 212’s bank details – this is far from obvious within the app.

This time I turned to Google and found a post in Trading 212’s community forum, which seems active. Somebody had already asked about setting up recurring payments, so after a bit of digging I’d solved my problem.

In my view, it’s positive that Trading 212 has an active community and members of its team reply to people on its forum and on social media. This is fine for finding answers to common issues.

But if you prefer to speak to a someone that can answer your questions in real time and help with a specific problem, it’s likely you’ll be better off with a service that offers phone-based support.

Chatbot: You can message Trading 212, but you aren’t immediately put through to a human

What is Trading 212’s platform like to use?

Trading 212’s platform is fiddly and takes some getting used to. If you choose the provider, it’s worth playing around with the various menus and icons to get a feel for how to access everything.

As an example, I used the mobile app to transfer a cash Isa to Trading 212 from another provider. This process was painless and took 13 days.

However, it’s not always clear how to navigate to the different functions. I initially expected a transfer option to appear within a larger menu that includes options for managing funds and viewing your payment history.

Instead, the option has its own dedicated section in the navigation bar and is highlighted with an icon. There’s also a button for transfers at the bottom of the platform’s home screen, but this is easily missed.

The good news is it’s quick to open an account, and if you have both a cash Isa and a stocks and shares Isa, moving funds between them is straightforward.

After I’d moved money from my cash Isa to my stocks and shares Isa, I started investing. I tested:

- On desktop: searching for and making a new investment

- On mobile app: setting up a regular investment

Searching for and making a new investment on desktop

Trading 212’s desktop and mobile versions are pretty much the same.

Once you log in from your browser, Trading 212 shows you how key markets and stocks are currently performing, and there’s a navigation bar that places investments into categories such as winners, losers and most owned.

The available options can seem bewildering, so you should have researched investments and know where you want to put your money before logging in.

You can look for a specific investment in the search bar at the top of the screen. Once you’ve landed on one, you just click buy and choose whether to purchase based on the number of shares you want, or how much money you want to invest. You can also set up limit orders, stop orders and stop limit orders.

Setting up a regular investment on the mobile app

Trading 212 allows you to set up regular payments into an investment pie. A pie is Trading 212’s term for a portfolio of investments created on the platform. You can choose a ready-made model pie, create your own, or copy pies from other users.

As an example, I’ve created a simple pie made up of an all-world ETF and a physical gold Exchange Traded Commodity (ETC). The all-world ETF has a target weight of 90 per cent and the gold ETC has a target weight of 10 per cent.

You click AutoInvest within the pie to set up the regular investment.

You can choose whether it gets distributed by the targets you’ve set or whether it self-balances the pie, so that more goes to underweight investments.

Trading 212’s AutoInvest is flexible. You can choose the frequency – for example, daily, weekly or monthly – and the day you want the investment to be made.

There are some disadvantages to the feature, however. You can choose payments to be taken from your card, but this is only free up to £2,000 in total. After this you’re charged 0.7 per cent, so this payment method can become expensive.

There’s no charge when the investment is made from available cash in your account, so ideally, you’ll want to set up a regular payment from your bank. But this isn’t intuitive. You can’t do this from within Trading 212 itself and instead you have to set up a standing order from your bank.

It’s possible to invest regularly into a single investment, but you have to put it into a pie first. This is straightforward if you don’t already own the investment. Otherwise you have to import it into a new pie, which is quite a convoluted process.

Social trading features

I like Trading 212’s social features, which allow you to follow other investors, join communities, and copy and share investment pies. The platform is lively, with plenty of buzz around popular investments.

Communities have sprung up on the platform around popular investors and investment pies, which give you the opportunity to learn about different investment strategies.

Trading 212’s social trading features are more established than Interactive Investor’s, who we have also reviewed.

What is Trading 212’s research and educational content like?

Trading 212 gives DIY investors a range of tools to help them make informed decisions.

Charts from TradingView are integrated into the platform, giving you the ability to drill down into the performance of an investment. There’s a host of options for setting up your data, including different chart types and indicators.

You can explore detailed company statistics and financials within the platform.

Trading 212 provides an AI analysis for some stocks, but in our view this shouldn’t replace human research – a disclaimer even says that Trading 212 can’t guarantee its accuracy.

While Trading 212 is strong on tools and there’s a news feed that pulls through helpful updates, it doesn’t offer much in the way of dedicated research.

It’s best to use the detailed information that Trading 212 provides as a springboard for doing your own research.

This naturally makes Trading 212 an option for investors with some experience already, but there’s a suite of engaging educational content available, including a dedicated learn section of the website and popular YouTube videos.

Trading 212: This is Money’s overall review

Trading 212 is a great platform for investors with some experience already. It’s very low cost and it’s quick to buy and sell investments.

The detailed financial information available within the platform, along with the social trading features, can give users the ammunition to make informed decisions.

In terms of negatives, Trading 212 doesn’t offer phone-based support, so investors should be prepared to deal with them online, where responses aren’t always instant.

I also found the platform itself difficult to use at times and needed to do some digging to find certain features.

And a final word of warning on CFDs. Once you’ve got a Trading 212 account, the platform makes it easy for you to open a CFD account, but most people should avoid trading these complex instruments. Trading 212 itself says 77 per cent of investors lose money when trading CFDs on the platform.

> Learn more about Trading 212 and open an account*

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .