[ad_1]

TEMIT, the country’s oldest emerging markets investment trust, is in fine form. Although its manager says there are ‘negatives’ out there on the horizon, he sees no reason why the asset class can’t deliver long-term annual returns in the high single-digits.

Acronym TEMIT stands for Templeton Emerging Markets Trust, a fund launched in 1979 with Mark Mobius (aka ‘Mr Emerging Markets’) at the helm.

Today, the £1.9 billion UK-listed fund is run by Chetan Sehgal out of Singapore and Andrew Ness, from Edinburgh.

‘We’re a team,’ says Sehgal, in London for the trust’s annual general meeting. ‘Every investment idea for the trust is discussed.’

The pair are supported by analysts across the globe – from China and India in Asia to Dubai in the Middle East and Argentina in South America.

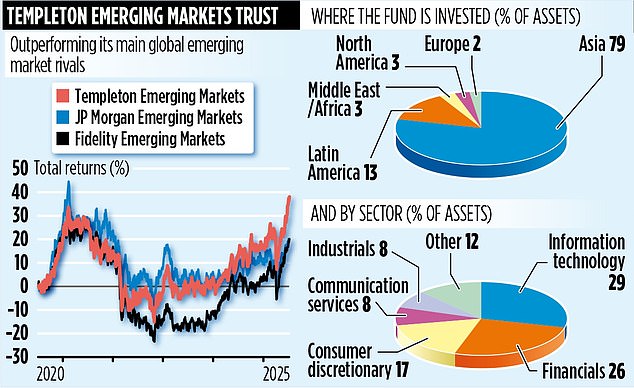

The performance numbers are good. When measured against similar trusts investing in emerging markets across the world, it is best in class over the past one and three years.

So over the past year a 19 per cent return compares to the respective 15 and 9.9 per cent gains registered by Fidelity Emerging Markets and JPMorgan Emerging Markets. Over three years, the respective gains are 41.8, 35.4 and 14.5 per cent.

Over the past five years, its 36.4 per cent return is beaten by both Utilico Emerging Markets and Mobius Investment Trust (also set up by Mark Mobius).

Sehgal says the emerging markets investment story remains powerful, fuelled by the ‘sustainable earnings power’ of many leading companies.

He also believes the improvement in corporate governance has been a positive.

The trust’s portfolio, comprising 87 stocks, has some corporate names among its biggest positions. They include Taiwan Semiconductor Manufacturing Company (TSMC), its largest holding at just under 13 per cent. Also, Indian banks ICICI and HDFC.

Sehgal describes TSMC as having ‘tremendous’ earnings growth potential while he says banking (in countries such as India and also Brazil) is a powerful ‘penetration story’ on the back of growing urbanisation and the need for consumers to have a bank account.

Another key holding, thriving on the back of India’s expanding urbanisation, is food delivery company Eternal, owner of the popular app Zomato.

‘India doesn’t have a convenience store network,’ says Sehgal. ‘So Eternal has done really well in the big cities where everyone wants something in a jiffy – whether it’s flowers delivered to

a loved one, a gold coin gift on a festival day or just a need for some essential groceries.’

Tariffs on exports to the US remain an issue for emerging markets – as do geopolitical issues, especially between Taiwan and China. ‘It’s a big headwind,’ says Sehgal of the ongoing tension between neighbours separated by the Taiwan Strait. ‘But there is no guarantee that it will end in military conflict – the current status quo is a possible solution.’

He says many Taiwanese companies, including TSMC, are also responding by setting up manufacturing operations elsewhere in the world.

Although the trust invests in Chinese companies – top-ten holdings include tech giants Alibaba and Tencent – Sehgal says that it will remain underweight for the time being.

The fund’s stock market code is BKPG0S0 and ticker TEM.

Total annual charges are reasonable at 0.96 per cent and the trust pays a dividend equivalent to an annual yield of 2.7 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .