[ad_1]

Has Surface Transforms finally found second gear?

Based on the latest update from the maker of carbon ceramic brakes, the answer is a guarded yes.

However, the share price move, up around 60 per cent over the week, suggests the market is more bullish on the company’s prospects.

The catalyst for the renewed enthusiasm was a trading update indicating that recent operational and funding woes are now firmly in the rearview mirror.

Revenue rose 72 per cent to £8.1million in the first half of 2025, driven by improved manufacturing yields and higher output. Gross cash stood at £1.2million at 30 June, supported by customer advances totalling £12.9million.

‘Key customers have and continue to be highly supportive of the company, and we remain hugely appreciative. The company remains in negotiations regarding the settlement of these advances, with repayments expected to commence in the second half of 2025,’ it said.

At 1.35p, the stock is down 18 per cent over the last year and has a long way to recover to the highs of early 2021 when it was worth almost 70p.

Turning to the wider market, it was a subdued week for the AIM All-Share, which crept up just 0.3 per cent to 775.94. Its benchmark, the FTSE 100, rose 1.3 per cent as it broke the 9,000 level for the first time.

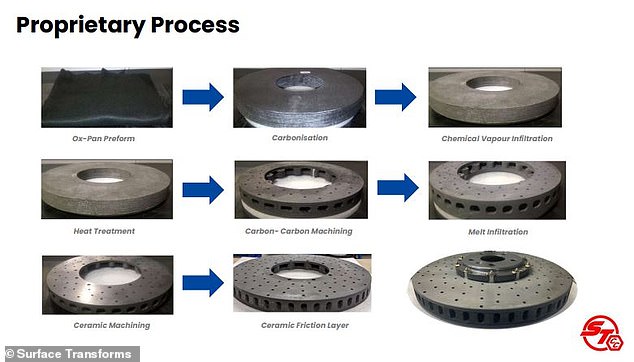

Surface Transforms makes carbon ceramic brakes

Among the week’s winners, EnergyPathways jumped 30 per cent after adding Siemens Energy and Costain to its partnership roster.

The company is developing the Marram Energy Storage Hub, or MESH, an ambitious project 11 miles off the Lancashire coast. MESH is designed as a multi-technology underground battery.

If built as planned, it would store up to 20 terawatt-hours, about 7 per cent of the UK’s annual electricity demand. The facility will combine three storage methods: natural gas, compressed air and hydrogen.

This could prove important as the UK remains reliant on intermittent renewables and gas imports. Proactive will have a deeper dive on EnergyPathways in the coming weeks.

Futura Medical, the maker of a fast-acting erectile function gel, advanced 26 per cent in the last five trading days. The stock has nearly doubled in value since the interim appointment of Lex Duggan, the former head of corporate development at Alliance Pharma.

Now to the week’s litany of losers. It was a good news, bad news week for investors in Jangada Mines. The good news is that it is buying into Brazil’s Paranaíta Gold Project. The bad news is that it is raising £800,000 via a discounted and dilutive share sale. Shares ended Friday 47 per cent lower.

A similar story played out at Union Jack Oil, which lost 40 per cent after announcing plans to raise £2million to fund growth in the US. So far, this has been a successful venture for David Bramhill and his team.

It is worth noting that the funding taps are now fully open for smaller companies, although the cost of capital remains high and, in some cases, punitive.

For AOTI, the damage was not self-inflicted. The wound care group warned of weaker growth for the remainder of 2025, citing continued disruption from US government healthcare initiatives.

While revenue is expected to be up 18 per cent to around $31million, growth slowed sharply in the second quarter.

The company expects full-year revenue growth in the mid-teens, with adjusted EBITDA margin in the low double digits, as headwinds from cost-cutting at the US Department of Veterans Affairs and Medicaid persist.

Finally, the two leaders in helium extraction are making significant progress that is yet to be fully reflected in their valuations.

Helium One last week secured a mining licence for its Southern Rukwa development in Tanzania and raised £10million to develop the project and assets in the US.

On Friday, Helix Exploration released encouraging news from its Inez-1 well at the Rudyard field in Montana.

The company drilled and tested the well, identifying around 140 feet of good-quality rock showing clear signs of gas, what the team calls a ‘gas effect’, in the Souris and Red River formations.

Using petrophysical logs, high-tech measurements taken inside the well, Helix compared Inez-1 to its earlier Linda-1 discovery nearby.

The results are promising, with the rocks matching up closely, suggesting further gas potential, according to SP Angel. ‘A good operational update from Helix,’ the broker added. Flow testing begins in early August, so stay tuned.

For the all the market’s breaking small- and mid-cap news go to www.proactiveinvestors.co.uk

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .