[ad_1]

The Federal Reserve defied Donald Trump once again last night and refused to cut interest rates as the US economy bounced back.

The central bank – whose chairman Jerome Powell has been urged by the US President to slash rates to 1 per cent – instead held them at between 4.25 per cent and 4.5 per cent.

The Fed was split, however, with two insiders appointed by Trump calling for a cut in the largest dissenting vote for more than 30 years.

It came just hours after figures showed the US economy grew at an annualised rate of 3 per cent in the second quarter – the equivalent of around 0.75 per cent on a quarterly basis. That followed a 0.5 per cent annualised contraction in the first quarter.

Trump took to social media to declare the number to be ‘way better than expected’ – though analysts cautioned the ‘sharp fluctuations’ in the data are the result of the ‘tariff dispute’ causing ‘distortions in foreign trade’.

The President went on to urge Powell to immediately cut rates, adding: ‘No Inflation! Let people buy, and refinance, their homes!’

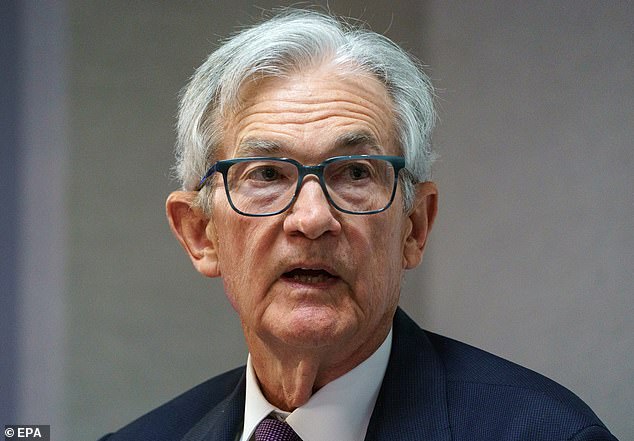

Pressure: Federal Reserve chairman Jerome Powell (pictured) has been urged by US President Donald Trump to slash rates to 1%

It marked just the latest attack on Powell by Trump, and followed a televised clash during a presidential tour of the Fed last week when the central bank chief was quizzed over the cost of renovations.

Isaac Stell of the investment service Wealth Club said: ‘Despite the sustained pressure, Powell and his deputies have once again defied the President’s wishes and chosen independence over political capitulation.’

But while the Fed did not cut rates, last night’s vote was the first since 1993 in which two members of the Fed’s seven-person Washington-based board of governors have dissented against the majority.

That stoked debate about how Trump’s public pressure to cut rates has threatened the independence of the central bank.

Both dissenters – Michelle Bowman and Christopher Waller – were appointed by Trump and called for rates to be cut by a quarter of a percentage point to between 4 per cent and 4.25 per cent.

Waller has been mentioned as a possible successor to Powell when his term expires in May next year.

Analysts cast doubt over the underlying health of the economy following the apparently upbeat GDP figures.

Christopher Rupkey, chief economist at financial markets research group FWD Bonds, said: ‘The economy is not in a recession is the good news.

‘The bad news is that this is not a report of robust growth.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .