Investment trust Strategic Equity Capital has a bold approach. It takes big stakes in companies it likes in the expectation that its judgment will be proved right, then rewards its shareholders with attractive returns.

Although the strategy is not foolproof, the current manager is making a mighty good fist of it.

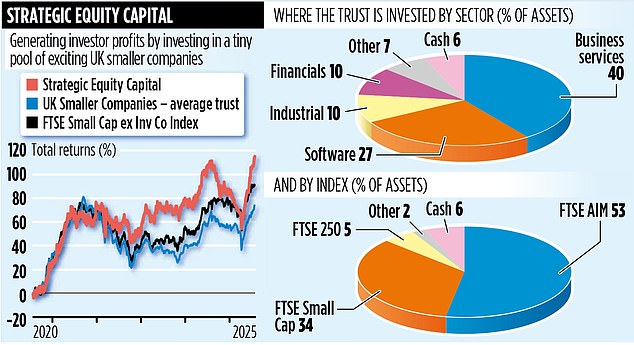

Since taking the reins in September 2020, Gresham House’s Ken Wotton has delivered shareholder returns in excess of 100 per cent, outperforming both the average for the trust’s peer group and its benchmark index, the FTSE Small Cap (excluding investment companies).

Wotton’s modus operandi at Strategic is to seek out opportunities in the smaller companies section of the UK stock market – a sector Gresham knows intimately as a result of running numerous other funds focused on it.

‘I look for companies with market capitalisations between £100 million and £300 million,’ he says, ‘and provided the quality and valuation are right, become one of the biggest shareholders.’

This approach, he says, gives the trust ‘muscle’ to ‘actively engage’ with the companies it buys. He adds: ‘At one end of the scale, engagement may be rather benign and just a question of supporting a company’s management plans.

‘But at the other, it may be helping a company find a non-executive board member or pointing them in the direction of a merger and acquisitions boutique if they become the target of interest from a potential private equity buyer.’

The fruits of this strategy can be rewarding. For example, one of the fund’s top-ten holdings is Inspired, which advises companies on optimising their procurement and usage of energy.

Wotton had been a backer of the company before he took over the helm at Strategic, and made it one of his first new holdings for the trust.

He then kept tickling up the stake, participating in the company’s raising of new capital late last year to reduce borrowings.

Inspired was then subject to a hostile takeover by Regent, an owner of gas and infrastructure companies. Strategic said it would not back the deal and put adviser Evercore in touch with Inspired.

The result was the discovery of ‘white knight’ HGGC, a US private equity firm, which trumped Regent’s 68.5p a share deal by offering 81p a share. The new offer is likely to be accepted in the coming weeks, providing the trust with a tidy profit.

The £168 million trust has 18 holdings – a concentrated portfolio, especially given the top-ten stakes account for nearly 80 per cent of assets. Wotton describes the other eight positions as ‘toe-hold positions,’ the trust’s ‘pipeline’. Some of these, he says, could benefit from the cash received from the sale of Inspired.

Wooton says mistakes are part of being a fund manager.

‘If you don’t make them, you’re not taking enough risk,’ But he adds: ‘Risk can be mitigated by engaging with company management – which Strategic does as a matter of course – selling out, or ensuring you have an appropriate-sized holding.’

The manager believes the trust’s prospects are ‘really attractive’ over the next three to five years, although he admits the FTSE AIM market – where a majority of the trust’s holdings are listed – has been undermined by Labour’s decision to reduce the inheritance tax attractions of holding AIM shares.

‘There has been a lot of forced selling of shares,’ he says, ‘and some have been derated.’

Annual trust charges are 1.2 per cent, the fund’s stock market ticker is SEC, and identification code B0BDCB2.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .