Investment trust JPMorgan Claverhouse is in pretty good shape. Bar any shocks in the coming months, the £507 million fund is well on its way to delivering 53 years of annual dividend growth.

And with interest rates cut on Thursday to 4 per cent, the managers of the UK-focused trust are very much in a positive mood.

‘The trust’s dividend record cannot be sniffed at,’ says Anthony Lynch, part of a three-strong team at JPMorgan Asset Management that oversees the fund’s 63-stock portfolio.

‘Bar City of London, no other trust investing purely in UK equities has a longer record of income growth and the annual increase over this period has averaged 9 per cent – well ahead of inflation.’

So far this financial year, the trust has announced two quarterly dividends of 8.4 p a share – 1.8 per cent ahead of equivalent payments made last year.

With a share price of just above about £7.90, the trust offers investors an appealing annual dividend yield of 4.5 per cent.

Lynch says another big plus is the quality of the investment team that have been together on the trust since June last year. He explains: ‘All three of us – Callum Abbot, Katen Patel and myself – have at least 15 years of investment experience under our belts and at least 20 years ahead of us. We’re in it for the long term.’

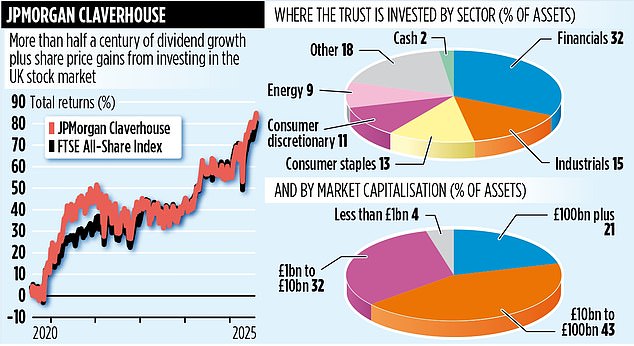

The performance numbers are solid, with the trust outperforming its benchmark – the FTSE All-Share Index – over the past one, three and five years.

Over five, for example, it has generated a total return of 78.8 per cent. The Index sits at 75.4 per cent.

Lynch believes the UK stock market remains cheap and says that with 70 per cent of the revenue from FTSE All-Share stocks coming from overseas, it represents a super way to secure exposure to global companies at bargain prices.

‘In the year to date, UK equities have outperformed both the US and global stock markets,’ he adds. ‘And there is no reason why it can’t continue.’ Although the trust’s biggest stakes are in

FTSE 100 stocks, the investment team has been buying more mid- and small-capitalised stocks.

Key positions have been taken in FTSE 250 stocks Serco and Dunelm.

‘Outsourcer Serco has had its troubles in the past ten years,’ says Lynch, ‘but the market misses the fact that 40 per cent of its order book is defence-related. As for Dunelm, the furniture retailer continues to grab market share, in the process outperforming the likes of Argos and John Lewis.’ The fund’s diverse portfolio allows the managers to mine dividend income from a multitude of sources, he adds.

The trust’s biggest sector position is in financials which account for just less than a third of the portfolio. Its biggest overweight position in this sector is NatWest.

‘This bank will become more profitable and offers the prospect of dividend growth,’ says Lynch.

Although the banks face a multi-billion-pound compensation bill as a result of the motor finance mis-selling scandal, he says the cost is likely not to be as big as many feared. Some bank shares rose after Monday’s announcement from the City regulator that the redress would total between £9 billion and £18 billion.

The trust’s annual charges total 0.63 per cent and will tickle down as its assets grow. Its market ticker is JCH and identification code 0342218.

The shares currently trade at a 6 per cent discount. Lynch says shares are bought back to ensure the discount stays as close to 5 per cent as possible.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .