[ad_1]

As the dust settles on its successful takeover of Awakn Life Sciences, investors are starting to appreciate the potential of Solvonis Therapeutics.

Yet the current valuation of £23million doesn’t tell the full story.

Or perhaps it tells its own tale: that the Brits are blinkered, even oblivious to a story unfolding on the other side of the Atlantic that has real and positive implications for Solvonis.

More on this later. First, it’s probably worth refreshing ourselves as to what the company is and does.

Quite simply, it is a biotech company that is developing potential treatments for illnesses such as alcohol abuse, post-traumatic stress disorder, and depression, where innovation and treatment options are sorely lacking. And they have been for a number of decades.

It has four programmes, one in phase III, which on a more progressive and capital-deep market such as Nasdaq would in and of itself justify at least one additional nought to Solvonis’ market capitalisation. Again, more on this later.

The SNV-001 treatment combines a carefully controlled dose of ketamine given by drip with a course of cognitive behavioural therapy, or CBT

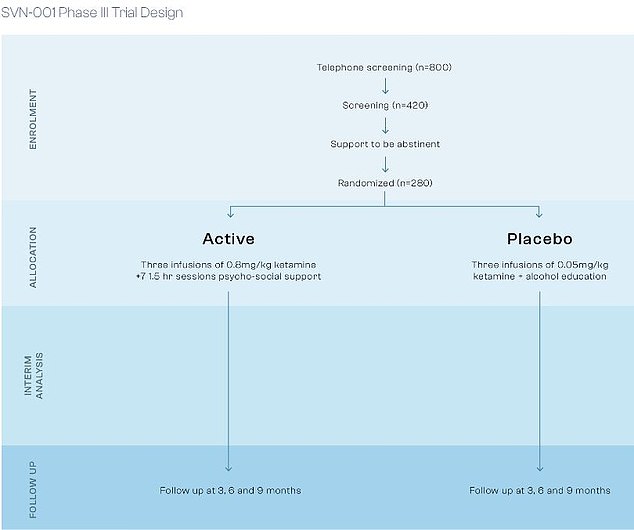

Its lead drug is SNV-001, an experimental treatment being tested in advanced clinical trials for people with severe alcohol use disorder (AUD).

It combines two approaches: a carefully controlled dose of ketamine (a dual anaesthetic and painkiller medicine that affects certain brain receptors) given by drip, and a course of cognitive behavioural therapy, or CBT, designed to specifically help prevent relapse.

The aim is to see if using these together can help people stay off alcohol more effectively than either treatment alone.

Early trial results for SNV-001 have been encouraging. In phase II testing, people given the treatment had 50 per cent fewer heavy drinking days compared to those who received a placebo.

Even more striking, on average 86 per cent of participants stayed off alcohol for six months after treatment, while only 2 per cent had managed this before joining the trial.

The results were so good that the UK Department of Health through the National Institute of Health and Care Research are co-funding the trial.

Looking ahead, the company plans to seek what is called a mixed-full approval in both the UK and EU, which could mean up to 10 years of market exclusivity if successful.

Its second asset is where the hidden value resides and where, I would contend, the UK investing public just isn’t recognising the upside.

Called SVN-002, it is an experimental treatment being developed in the much larger US alcohol addiction treatment market

It uses esketamine, closely related to ketamine, and, crucially, a compound already being used in Johnson & Johnson’s new blockbuster, Spravato, in nasal form, to combat treatment-resistant depression.

Top marks if you made the link. Don’t worry if you didn’t; but pay attention at the back!

So alike are the two compounds that Solvonis last month kicked off a process designed to provide scientific ‘bridging’ data linking SVN‑002 to Spravato.

By referencing the existing drug, Solvonis aims to pursue the 505(b)(2) regulatory pathway, a route that allows companies to rely on existing data to streamline approval processes.

Not only this, the company also hopes SVN-002 will be eligible under the same reimbursement codes as Spravato, potentially saving significant time and cost.

Now, here’s the eyes-on-stalk moment. Spravato is already generating annual revenues of more than $1billion and analysts believe this figure could actually peak at $5billion.

However, its addressable market is a couple of million Americans with severe depression.

Contrast this with the estimated 22 million people in the States who struggle badly with alcohol. As they say in the States, you do the math(s).

American investors have not been slow to cotton on. Companies listed across there paddling in similar, or adjacent, pools, the likes of Atai Life Sciences, MindMed, GH Research and Compass Pathways, have been in lift-off mode.

Meanwhile, pharma giant Abbvie is reported in the US business press last week to be preparing a $1billion offer for a privately owned-US peer of Solvonis, a company called Gilgamesh Pharmaceuticals.

In other words, real buzz around the sector in the States that has so far been absent here in the UK, which is also reflected in valuations stateside, which are orders of magnitude larger than Solvonis.

Atai, for example, has programmes barely emerged from phase I and carries a market capitalisation of more than $800million.

That reflects America’s greater understanding of not just biotech, but the potential of this new emerging area of treatment.

Value inflexion points for companies such as Solvonis tend to come at the end of clinical studies – phase II usually, but also phase III.

This is when large pharma is sufficiently emboldened to invest in the expensive process of follow-on studies, and/or pouring tens of millions of dollars into gaining regulatory sign-off.

A licensing agreement of this type not only provides third-party validation of the work to date, it comes with financial kickers such as upfront and milestone payments.

We already know that Solvonis has drafted in Pharma Ventures, a specialist in partnership and alliances of the sort outlined above, to shop SNV-001.

So, one can safely assume conversations are taking place.

It will be interesting to track the role in negotiations played by Solvonis chair Dennis Purcell.

He is also a director of IGI, which recently cut a $1.9 billion deal with AbbVie, with $700million of that upfront.

Okay, this was in the oncology arena, but Purcell has first-hand experience of going toe-to-toe with big pharma.

And this will be crucial when talks hit the nitty-gritty phase.

A recent research note penned by the team at Singers used the net present value of Solvonis’ two clinical stage assets, allied to what it calls a ‘risk-adjusted patient-based forecast’, to come up with a 1.6p price target.

So, what does all this mean? Well, it suggests Solvonis’ share price of 0.37p may not reflect the company’s true potential.

For all the latest small- and mid-cap breaking news go to www.proactiveinvestors.co.uk

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .