[ad_1]

The boss of Rolls-Royce has said the FTSE 100 engineering giant could become the UK’s biggest listed company.

And chief executive Tufan Erginbilgic yesterday backed London as he dismissed the idea that Rolls might follow other major firms by switching its listing to New York.

FTSE heavyweights AstraZeneca and Shell have been flirting with a switch in search of higher valuations in what would be a hammer blow for the London Stock Exchange.

The UK’s stock market has suffered an exodus of other firms in recent years, with fintech darling Wise the latest to say it will head across the Atlantic.

Erginbilgic said: ‘It’s not in our plan. I don’t agree with the idea you can only perform in the US. That’s not true and hopefully we have demonstrated that.’

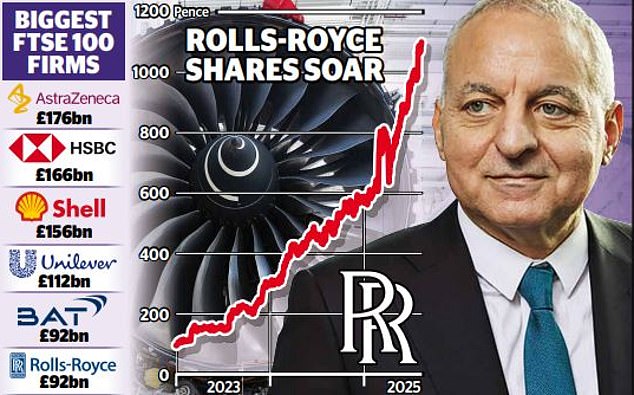

He has overseen a tenfold increase in the share price since taking over in 2023 – earning him the nickname ‘Turbo’ Tufan – but his comments point to an ambition to go still further.

Ambitious: Tufan Erginbilgic has said the FTSE 100 engineering giant could become the UK’s biggest listed company

That would mark an even more stunning turnaround for a company nearly destroyed by the pandemic, when international travel was halted, killing demand for its aeroplane engines.

Now, Erginbilgic believes that plans to power the explosive boom in artificial intelligence (AI) technology using Rolls’ nuclear reactors could help it become the most valuable stock on the FTSE 100 index.

It has been boosted by contracts to build mini-nuclear reactors, winning the contract for Britain’s Small Modular Reactor programme and also has an agreement with the Czech government.

‘There is no private company in the world with the nuclear capability we have. If we are not market leader globally, we did something wrong,’ Erginbilgic told the BBC.

‘I believe the growth potential we created… in our existing business and our new businesses, actually, yes – we have that potential [to become the most valuable in the FTSE 100].’

Rolls is the sixth-largest company with a market capitalisation of £92bn, behind Astra, HSBC, Shell, Unilever and BAT.

Erginbilgic has been credited with turning the 119-year-old company’s fortunes around

Taking the helm at the start of 2023, former BP executive Erginbilgic vowed to quadruple profits and dramatically fatten margins at its main civil aerospace unit, which has been boosted by the recovery of the travel industry.

The firm is also set to benefit from increased defence spending as Europe races to rearm.

Susannah Streeter, analyst at Hargreaves Lansdown, said: ‘The ambition to become the Footsie’s biggest company is a vote of confidence in the London market and will be welcomed, given the recent exodus.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .