[ad_1]

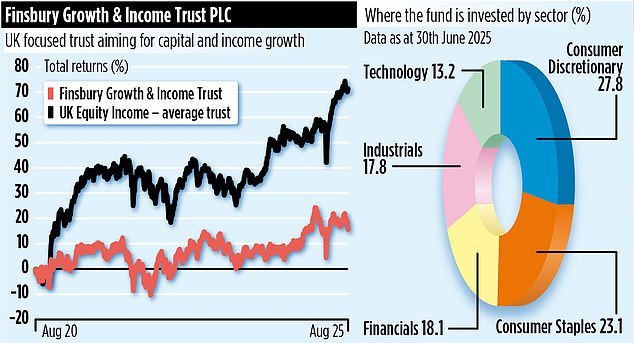

Before the pandemic, Nick Train’s Finsbury Growth & Income Trust reliably beat the market. But the past five years have not been kind to Train’s concentrated buy-and-hold portfolio of well-known UK companies.

Finsbury Growth & Income last beat the market in 2020, when its shares fell just 0.7 per cent in a year in which the UK stock market fell 11.6 per cent.

Although the UK stock market staged a post-lockdown bounce, since then it has been out of favour and some of the big hitters in the Finsbury Growth & Income portfolio, such as Diageo, Burberry and Schroders, have been deeply unloved by investors.

But Train is optimistic, saying he believes there is a cohort of more growth-orientated companies coming through in the UK that are world class and can profit from rapid advances in technology.

While investors have focused on chasing up US tech giants’ share prices amid the artificial intelligence boom, Train says they are some FTSE-listed companies that also offer a huge opportunity to profit from the application of AI.

He says: ‘If you look at the shape of Finsbury’s portfolio over the past four or five years, there has definitely been a shift towards these London-listed data and data analytics software companies that seem to us to have an extraordinary opportunity ahead of them. And arguably a really intriguing valuation opportunity as well.’

Chief among those is RELX, formerly Reed Elsevier. The information-based analytics provider for businesses is a global leader in its field and Train says that is reflected in how it has gone from the 68th largest company in the FTSE 100 in 2000 to sixth today.

He says the next 20 years could be as good for RELX as the past two decades, citing its AI tool for lawyers delivering a 280 per cent return on investment for early adopters. Train says if this can be repeated in the scientific and drug research market, the potential for investors ‘and humanity’ is great.

Among Train’s other holdings that he believes can benefit from AI to improve their services and profits are property firm Rightmove and credit scorer Experian.

He also took a rare new position last year, buying into the world’s largest shipping broker Clarkson. He says it is a ‘truly world class UK company with a clear opportunity to use technology to create new value.’

Though the UK stock market has staged a recent resurgence, with the FTSE 100 up 11 per cent since the start of the year, Finsbury has continued to lag, with a return of just 0.3 per cent. The trust has a share price total return of 9.7 per cent over the past year, but just 15.8 per cent over five years. Over the past decade though, the return is a much healthier 90 per cent.

Train, who has run Finsbury for almost 25 years, says he has tackled the past tough years making sure he ‘stuck to a clear set of principles’.

He says: ‘It is no fun underperforming. And it really behoves you in those circumstances to behave in a disciplined way. I hope that we have done that.’

Train believes his Warren Buffett-influenced investing style of constructing a concentrated portfolio of high-quality shares will shine through.

Finsbury Growth & Income shares are trading at 7 per cent below net asset value, offering the chance to buy in at a discount. Ongoing annual charges are 0.61 per cent and its unique stock market identification code is 0781606.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .