Vietnam may be under communist rule, but like China, its larger neighbour to the north, the state’s economic focus is very much on delivering sustained growth through a thriving private sector.

It’s an approach, labelled ‘economic reform 2.0’, that appears to be working rather well. In the first six months of this year, the economy grew by 7.3 per cent and is on course to deliver double digit growth next year and beyond.

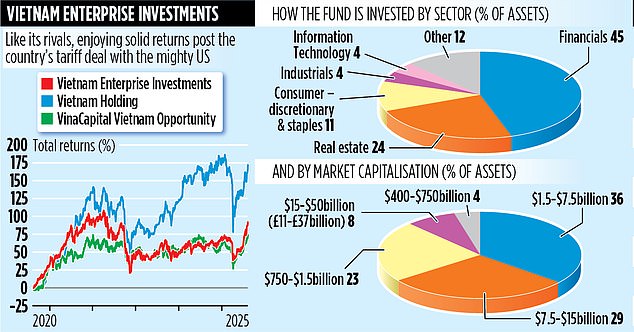

Such a healthy domestic backdrop has also led to a strong stock market – and solid returns from the three London-listed investment trusts that are 100 per cent focused on Vietnam: namely, Vietnam Enterprise Investments Limited (VEIL), Vietnam Holding and VinaCapital Vietnam Opportunity. Over the last year, they have recorded respective share price gains of 19.7, 5.5 and 6.6 per cent.

The largest of the three is VEIL, a £1.5billion fund run by Dragon Capital, the country’s largest private asset manager founded more than 30 years ago.

Dragon has £13billion of funds under management across South-East Asia, almost a third of which is invested in Vietnam. The trust, part of the FTSE 250 index, is run by a triumvirate of managers and invests for capital growth, so is not suitable for income seekers.

Although Vietnam recently had a 20 per cent tariff imposed on exports to the US by President Donald Trump, VEIL’s Thao Ngo – one of the fund’s three managers – says it has had little adverse impact on the stock market.

She says: ‘The stock market is built around companies which are focused on the domestic economy. That means the banks, real estate companies and infrastructure giants. Just 1.5 per cent of the revenues generated by listed companies are linked to US exports. So, tariffs have done little to dampen down market sentiment.’

The key for the stock market to continue performing, she says, is for the economy to keep growing. ‘GDP [gross domestic product] growth in the first half of this year was the strongest in nearly two decades,’ she adds, ‘supported by robust industrial production and consumer consumption.

‘With To Lam, general secretary of the communist party of Vietnam, determined to drive through further economic reform in a quest to turn the country into a developed high-income nation by 2045, growth is very much the name of the game.’

The trust’s portfolio, comprising 42 stocks, is set up to benefit from the country’s emphasis on domestic growth. Its largest sector is financials, especially banks. Six of its top ten holdings are lenders. Among them is Techcombank. ‘What we love about this bank,’ says Ngo, ‘is its diversity and focus on innovation. It has diversified into wealth management, offering services on digital platforms.’

Another key stake is in Asia Commercial Bank, which the trust has invested in since 1996. Ngo says: ‘It was the first private bank in Vietnam to lend to consumers, and it continues to develop, diversifying into loans for small and medium sized enterprises.’

Despite the positive backdrop, VEIL’s shares trade at a double-digit discount to the value of the fund’s underlying assets.

This is despite the trust buying back shares.

A game changer would be if Vietnam’s stock market was upgraded from ‘frontier’ to ’emerging’ market status, triggering greater interest from big overseas investors. Such an upgrade could happen next year, but it’s not a given.

VEIL’s annual charges are 1.85 per cent and its stock market identification code is BD9X204. It should represent only a small slice of a diversified portfolio.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .