[ad_1]

A spike in the cost of UK borrowing is bad news for Chancellor Rachel Reeves but this offers investors willing to lend money to the Government a chance to lock in generous returns.

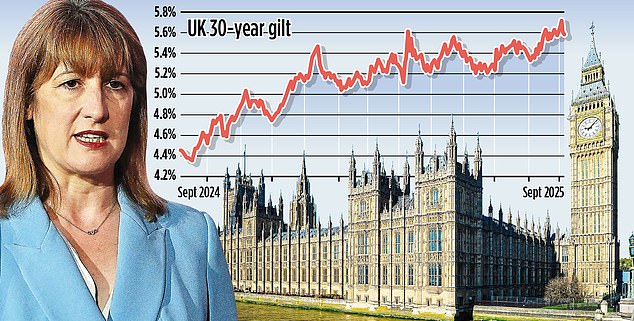

Turmoil in the bond markets led to the yield on 30-year gilts – long-term UK debt – hitting 5.75 per cent last week.

This presents an opportunity for investors to buy gilts direct and hold them to maturity to pick up higher rates.

Or if rates fall back again, they could sell at a tax-free profit earlier, as capital gains tax isn’t levied on gilts.

Lending money to the Government by buying its gilts direct is seen as a low-risk and lucrative earner by a growing number of ordinary investors. They can currently turn Reeves’ misfortune to their advantage, by securing an annual return above 5.5 per cent for decades.

DIY investment platforms have made it easy to buy single gilts and stash them in your Isa or pension while financial advisers increasingly tend to recommend them to higher earners for the tax perks. Here’s what you need to know.

What are gilts and how do you buy them?

The UK issues new debt, called gilts, to help fund the business of government, from borrowing for infrastructure projects to fulfilling spending commitments and refinancing existing debt.

Gilts are usually issued for a set period – for example five years, ten years or 30 years – and pay a regular interest-based income, called the ‘coupon’. The face value of the gilt is paid back at the end of the term, known as maturity.

Investors buy gilts in return for this income, knowing that if they hang on until the maturity date they get all their money back, except in the unlikely event that the UK defaults on its debt.

But you can buy and sell gilts through their lifetime on the secondary market, where they may trade for more or less than face value depending on the demand for the interest rate they pay. This means investors can also sell out earlier and might get more than they bought the gilt for. A special feature of gilts is that these profits are free of capital gains tax.

Many top investing platforms – including Hargreaves Lansdown, Interactive Investor and AJ Bell – offer gilts. You can check their sites for a list of what’s currently available and upcoming issues.

You can also buy direct from the UK Debt Management Office, which offers a service run by Computershare. Victoria Hasler, head of fund research at Hargreaves Lansdown, says: ‘They are popular partly because they are relatively low risk if you are prepared to hold them to maturity – and you can buy gilts that mature within anything from a few months to a few decades.

‘Investors like the income-generating potential – but perhaps most popular of all is the fact that there’s no tax to pay on any profit when they mature or you sell up.’

Why is there trouble within the bond markets?

The cost of long-term borrowing has risen in the UK due to concern over whether the Government can get the economy growing enough to meet its spending and debt obligations. The prospect of a tough, tax-raising Budget to get the country’s finances on track is failing to calm nerves.

There is also a wider bond sell-off under way. International investors are worried about US President Donald Trump’s attacks on the Federal Reserve, undermining the US central bank’s independence, while his tariff policy appears to be coming unstuck in the courts.

The French government is also facing collapse over failed attempts to control spending.

Tom Becket, co-chief investment officer at wealth manager Canaccord Wealth, says: ‘Investors are clearly skittish around the problems in the UK gilt market, where concerns over the Government’s fiscal approach, as well as sticky inflation and challenges over future Bank of England rate cuts, are presenting a miserable mix.

‘It is very hard to know how the ‘doom loop’ in UK bond markets will ease, given the reality of the Government’s finances and the likelihood that inflation in the UK reaches 4 per cent by the end of September.’

Why is buying the gilts direct attractive for higher earners?

Gilts can be very tax efficient, especially for those paying higher tax rates looking to invest outside Isas and pensions.

Many opportunities lie in the secondary market, where you can buy gilts trading below redemption value and look to make a capital gain. While the coupon is subject to tax, just like cash savings interest, price gains are exempt from capital gains tax.

This works with gilts with low coupons, where you gain on any uplift from the purchase price.

Jason Hollands, from wealth manager Evelyn Partners, warns investors must be ready to do some maths regarding ‘yield to maturity’ and tax to make this work.

The ‘yield to maturity’ is the annual return you would get from the gilt at the price paid for it, if you held it till the end date. It accounts for the interest paid along with whether you bought it at above or below face value.

Hollands says: ‘It isn’t quite as straightforward as picking the gilts with the highest headline yields. If you look at platforms offering execution-only dealing in gilts, the information provided is typically limited to coupon, maturity date and price – so you would have to work out the yield to maturity, and then the post-tax yield.’

He suggests getting a financial adviser to help if you are unfamiliar with direct investing in bonds.

Should you really opt for a bond fund instead?

Many investors find it easier to buy a bond fund and let a professional manager do the hard work of deciding which bonds to buy or sell and spread the risk as their value rises or falls over time.

A professional will be better placed to forecast bond market moves. Buying a bond fund means stumping up management fees though, and you don’t get the option of holding bonds to maturity and getting your capital back.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .