[ad_1]

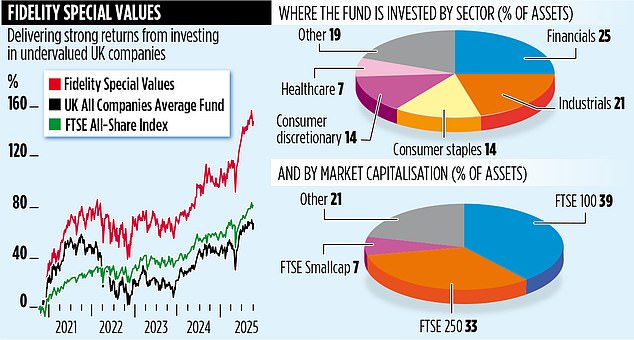

Investment trust Fidelity Special Values has provided some rather splendid returns for shareholders in recent years by seeking out undervalued British companies and then waiting for their shares to bounce back.

And according to its investment manager, the good times are far from over as the FTSE 250-listed fund benefits from both a renaissance of the UK stock market and some astute stock selection.

While the £1.2 billion trust doesn’t automatically exude investment glamour, its recent performance figures suggest otherwise.

For the five years to the end of last month – also its financial year end – it delivered share price returns of 140 per cent.

That was enough to beat both the FTSE All-Share Index (78 per cent) and, somewhat surprisingly, the Nasdaq Composite (88 per cent) in the United States, an index that includes some of the country’s biggest and liveliest tech stocks.

‘Yes, it has been a really good five years for our investors,’ says Alex Wright, who along with Jonathan Winton runs the 90-strong portfolio. ‘We’ve beaten US exceptionalism, although the trust’s share price did take a big hit in 2020 as a result of the fallout from [the Covid] lockdown, meaning our five-year numbers start from something of a low point.

More importantly, Wright now believes the trust can deliver double-digit annual returns in the immediate future.

He explains: ‘There is good earnings growth across our portfolio – 10 per cent for both 2026 and 2027.

‘If we see their profits advance by 10 per cent a year and dividends on top of 3 per cent, that implies an annual total return of 13 per cent for the next two years. That is an appealing return.’

Another plus for shareholders may come from a rerating of some of the trust’s holdings.

Wright says shares that the trust invests in are trading on average at a lower value than the rest of the UK stock market.

If that were to change – or if the market was rerated across the board (it remains cheap compared to other equity markets) – it would provide an extra performance

fillip. The trust invests across the UK stock market, with the biggest slug of its holdings in FTSE 100 stocks – the likes of Aviva and tobacco giants BAT and Imperial.

Yet Wright says the undervalued stocks he likes to buy are now increasingly to be found outside the main index – especially in the mid cap space.

One recent trust purchase was the property company Derwent London, which is a constituent of the FTSE 250.

‘Commercial property as an asset class has been out of favour for a while, especially since 2020 and the growth in working from home,’ explains Wright.

‘But Derwent is an attractive investment for us. As its name suggests, its portfolio comprises prime, high-grade City of London and West End office buildings, and Derwent is seeing rental incomes start to tickle up.

‘It also offers an appealing dividend just short of 5 per cent.’

The manager believes the trust will continue to benefit from a performance boost as some of the companies it holds attract interest from either overseas buyers or private equity.

Financial services group Just, a top-ten trust holding, was the latest company to be bought – by global investment firm Brookfield Wealth Solutions.

Fidelity Special Values’ stock market ticker is FSV and its identification code is BWXC7Y9. Total annual charges are 0.7 per cent and dividend yield is 2.5 per cent.

Dividends paid in the financial year to the end of August 2024 totalled 9.54p and the current share price is around £3.80.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .