Most equity income investment funds are built around a portfolio of dividend-friendly companies. But not investment trust Invesco Global Equity Income.

The managers of this £250 million fund do things rather differently, and it seems to be working rather well. The stock market-listed trust, formed last year from the restructuring of another Invesco fund, Select, has enjoyed a strong 12 months, generating overall returns in excess of 27 per cent.

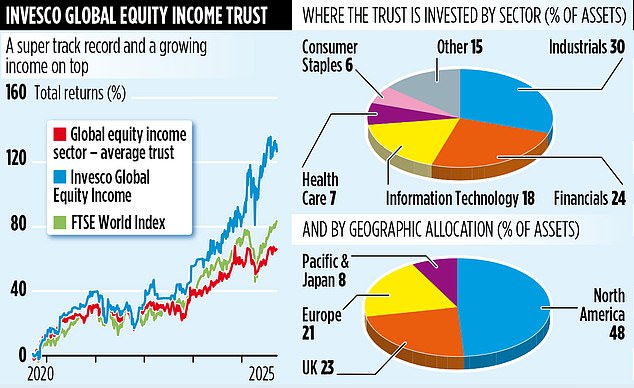

To put this into perspective, it compares with a 10.4 per cent gain by the average global equity income trust and a 16 per cent increase in the FTSE World Index.

The trust is managed from Invesco’s offices in Henley-on-Thames, Oxfordshire, by Stephen Anness (head of global equities) and Joe Dowling.

Although the pursuit of income is crucial to how they run the portfolio – it currently provides an annual dividend of about 3.4 per cent – Anness says the overriding mission is to provide a trust to investors which can deliver performance in all market conditions.

‘As managers, we’re not wedded to one particular investment style,’ says Anness. ‘We’re very much open-minded. We want a portfolio robust and flexible enough to extract returns from different parts of the market, according to where we see value.’

It’s a point also articulated by Dowling. He says: ‘What the 42 companies we hold in the trust have in common is that they are really good businesses which will be bigger in five, ten and 20 years – and which, in our eyes, are attractively valued.’

The result is a portfolio which accommodates fast-growing companies – such as US tech giant Broadcom – which pay little or no dividends. These provide the impetus behind the trust’s capital gains. Alongside these are dividend-friendly companies such as drinks giant Coca-Cola Europacific Partners and private equity giant 3i. These stocks represent a majority of the trust’s assets.

The final part of the fund’s portfolio comprises companies which are in dividend recovery mode. Among this category is engineering giant Rolls-Royce Holdings.

‘The company has undergone an unbelievable transformation,’ says Anness. ‘Whether it’s nuclear power, defence or data centres, it’s powering ahead and winning more business. From an investor’s perspective, it’s all rather exciting.’

Over the past year, Rolls-Royce shares have jumped 128 per cent.

Anness and Dowling have a list of 140 stocks to pick from, plus another 100 companies under review. This, says Dowling, allows them to rotate the portfolio’s stocks when new areas of investment value present themselves.

Geographically, the trust’s assets are skewed towards North America, although more than 20 per cent of the portfolio comprises UK companies.

The fund’s dividend strategy, directed by its board, is based on delivering an annual income equivalent to four per cent of net assets (the trust’s assets minus borrowings). In general terms, this means that if the assets grow the dividend will too.

In the last financial year to the end of May, dividends – which are paid quarterly – totalled 12.52p a share. So far this year it has paid an initial dividend of 3.375p, up on last year’s equivalent payment of 3.13p. The shares currently trade at a small premium and are priced just above £3.70.

Ongoing charges are reasonable at 0.8 per cent, the fund’s stock market ticker is IGET and the identification code is B1DQ647.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .