[ad_1]

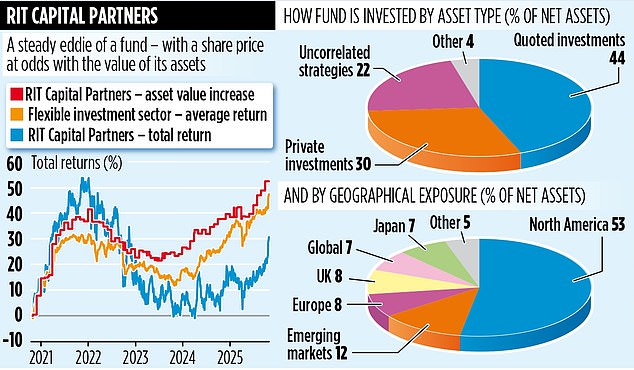

Investment trust RIT Capital Partners is a jack of all trades. In the search for returns, it invests in a range of assets – from physical gold to private and stock market listed firms.

The result is a diversified vehicle that delivers solid rather than racy performance figures, though it is not immune from occasional hiccups, as its recent investment record proves.

Over the past year it has delivered shareholders a satisfactory total return of 19.3 per cent, compared with 22.2 per cent from the FTSE All-Share Index, according to data provider Trustnet.

In the previous one-year period (the 12 months to October 30, 2024), it generated 6.6 per cent – but in the year before that, a hefty loss of 20.7 per cent. The respective figures for the FTSE All-Share were gains of 17.1 and 6.5 per cent.

These numbers suggest that the investor journey is not always as smooth as you would expect from a broadly invested trust with assets of £4.3 billion.

But Maggie Fanari, the trust’s chief executive, insists that RIT offers investors something different. She says: ‘It’s a portfolio providing investors with opportunities and investments they wouldn’t be able to access themselves. It’s also globally diversified and resilient.’

From an investor perspective, the trust can appear a complex and unusual beast. This is a result of its multi-asset approach, widespread use of specialist funds rather than direct investments, and a 30 per cent exposure to unquoted businesses.

Until recently, this complexity was exacerbated by a reticence to engage with shareholders and the investing public. This conservatism stems from its history: it was founded by the late investment banker Lord Jacob Rothschild, and to this day the Rothschild family remains its largest shareholder. As a result, it has been more inward than outward looking.

But Fanari and the trust’s board are determined to bring the investment vehicle to the attention of a wider audience. The fund now has its own website and holds webinars with shareholders.

Though its equity holdings includes familiar names such as Amazon and Microsoft, it’s the private investments that excite Fanari. This year, returns have been boosted from investments in businesses such as Xapo (a fintech company specialising in cryptocurrencies), investment platform Webull and artificial intelligence specialist Scale AI.

Respectively, a management buyout, stock market flotation and a stake bought by tech giant Meta enabled RIT to exit these businesses, banking big profits.

Further profits could come next year if holdings in private businesses Kraken (a digital asset platform) and Motive (a fleet management software company) are sold as a result of the companies going public.

Though such successes are proof that RIT’s multi-asset approach can reap rich rewards, the trust’s shares are unloved. They currently trade at a significant discount of 23 per cent to the value of the underlying assets.

Fanari says reducing the discount is a ‘top priority’, adding: ‘We’re making strides. We’re buying back shares, being more transparent in what we do, and engaging with shareholders more than ever before. The discount will narrow.’

Investment trust analysts at City firms Jefferies and Investec like what the trust is doing, especially on its unquoted portfolio. Both now classify its shares as a buy.

Annual charges are reasonable at 0.76 per cent and the trust pays a decent dividend – 43p per share in the last financial year with the shares currently trading at £21.65.

The trust’s stock market ticker is RCP and the code 0736639.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .