[ad_1]

The mission of investment trust Pantheon International is to put shareholders first. It’s a worthy objective which in the current investment climate is difficult to fulfil.

Like many trusts which provide investors with exposure to private companies, shares in the £2.2billion fund currently stand at a whopping 36 per cent discount to the value of their underlying assets. In other words, the price of its liquid shares does not reflect the value of its illiquid assets.

And so far, whatever the trust’s board has done to try to reduce the mismatch – such as the buying back of shares from investors – it has not really worked.

‘There is a scepticism out there about the value of private equity investment trusts,’ admits Charlotte Morris, co-lead fund manager of Pantheon. ‘When equity prices in public markets fell in 2022, the valuations of private companies didn’t fall as much. As a result, there is a view that private equity assets are overvalued.’

Morris believes that there needs to be a ‘pick up in private equity activity’ to prove that current valuations are ‘real’. With regard to Pantheon, she says she is ‘comfortable’ about the valuation of the trust’s assets, implying that at some stage the trust’s discount should start to whittle away.

If this were to happen – and there is no guarantee that it will – shareholders would benefit from a performance uplift.

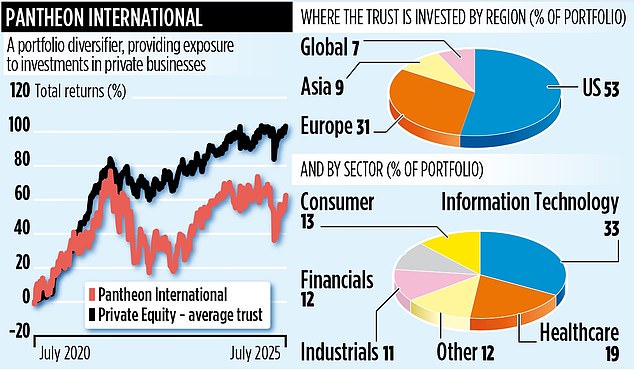

Private equity trusts are important portfolio diversifiers, enabling investors to get exposure to an investment bucket where access is otherwise difficult.

They make their money by buying unlisted companies, helping them to improve their business operations, and then selling them at a profit. Realising a profit is usually via the sale of the private company to a rival or another private equity investment manager.

Pantheon sees itself as operating at the low-risk end of the private equity spectrum. ‘We like to invest in stable, rather boring businesses,’ says Morris. ‘We’re not big risk-takers.’ Risk is further diluted by the fact that it does a lot of its investing with other private equity specialists such as Hg, IK Partners and Index Ventures.

Often, this means Pantheon committing a sum to a round of fundraising organised by one of these specialist companies. The money is then used over time to invest in a portfolio of private businesses with Pantheon (hopefully) making gains whenever one of these assets is subsequently sold.

The result is a trust where 80 per cent of its portfolio comprises stakes in 500 companies. The other 20 per cent, says Morris, comprises ‘smaller positions’, although Pantheon doesn’t disclose how many individual stakes it has in total. Opaque.

A typical trust holding is Dutch discount retailer Action.

‘It’s a little bit like Aldi and Lidl,’ says Morris, ‘in that it offers discounts on essential household goods on a rotating basis. But it doesn’t do food.

‘We initially invested in 2020, and it has proved a resilient and growing business. We invested via private equity company 3i, have not sold down our stake, and at some stage we will look to exit, crystallising the gains we have made.’

The trust, part of the FTSE250 index, has generated returns over the past one and five years of 2.8 and 59.8 per cent respectively. All of this has come from the share price (currently standing at around £3.13). It doesn’t pay shareholders a dividend.

The fund’s annual charges total 1.31 per cent although there is an additional performance fee that kicks in when the trust has a good year (it didn’t in the financial year ending May 31, 2024).

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .