[ad_1]

Investment manager Masaki Taketsume has just spent the past two weeks in the UK marketing the Japanese fund he runs to an array of wealth managers and advisers.

Now safely back in Tokyo, he was pleased with the way it all went – although promoting his UK listed investment trust Schroder Japan is not a difficult task.

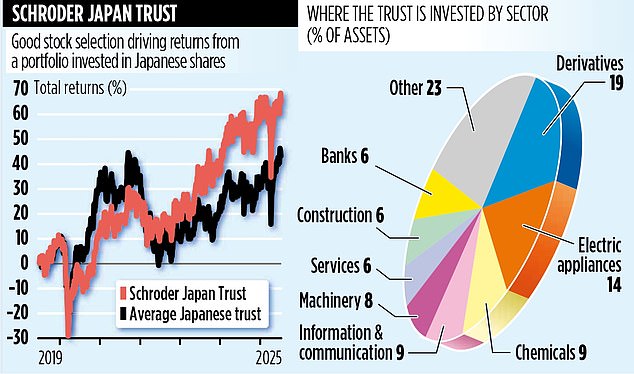

Since Taketsume took over at the helm of the £324 million trust in July 2019, he has comfortably outperformed his peer group, delivering a return of 65 per cent against the average for rival Japanese trusts of 45 per cent.

Equally importantly, he has generated shareholder returns in excess of the benchmark he strives to beat – the Tokyo Stock Exchange First Section Total Return Index. In each of the past five one-year discrete investment periods, the trust’s share price has provided a return above that from the index. Consistency is the name of the game.

‘Good stock selection is the main driver for the trust’s solid performance numbers,’ says Taketsume.

‘We’ve assembled a portfolio comprising companies which we bought when they were cheap. We’ve then made money for shareholders in response to their strong business franchises and management excellence delivering significant earnings growth and a share price re-rating.’

Among the trust’s top ten holdings is Japanese beer giant Asahi, which Taketsume bought a stake in two years ago. The company, he says, has done brilliantly in cementing its reputation across Europe for its focus on premium beer – and non-alcoholic beer. It also owns Peroni, which it bought from SABMiller in early 2016.

On top of this, Asahi has steadily been increasing its remuneration to shareholders through regular share buybacks and dividend payments. ‘It ticks both our boxes,’ the manager says. ‘An established franchise and a management team determined to do the right thing for shareholders.’

Another key holding among the 65-strong portfolio is Sanki Engineering. Taketsume says: ‘It’s a construction company with a reputation for the manufacturing of air conditioners. It’s got a big market share and pricing power which has fuelled significant earnings growth.’ Already this year, the company’s shares are up more than 30 per cent.

Although the trust still states in its investment objectives it strives for capital growth for shareholders, it now has a strong income bent. The trust pays a quarterly dividend, equivalent to an annual income of around 4 per cent.

The income focus is a result of Japanese companies generally becoming more shareholder friendly. It is also a reflection of the trust’s board to make the fund more appealing to a broader church of investors.

While 25 per cent tariffs on exports to the US are a negative for the Japanese economy, Taketsume says shipments to the US account for only a fifth of total exports. The trust’s portfolio, he says, is dominated by businesses focused on the domestic economy.

The only lingering issue for the trust is that the share price does not reflect the value of the fund’s assets. It means the shares trade at a 9 per cent discount. It’s not a problem unique to Schroder Japan, but it’s frustrating for the board and existing shareholders.

Taketsume originally ran the trust from London but moved back to Tokyo in early 2023 for family reasons. He says that where he is based has little impact on his ability to generate returns for investors. ‘It is the right decision making that counts,’ he adds. The fund’s stock market ticker is SJG and identification code 0802284. Annual charges total 1.14 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

[ad_2]

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .