Glencore has decided to keep its stock market listing in London in a rare boost for the beleaguered exchange.

The mining giant, one of the largest companies on the FTSE 100, said earlier this year that it was considering whether to move its main listing to New York in what would have been a devastating blow to the City as it struggles to remain competitive as a global financial hub.

But yesterday, Glencore said it had shelved the plans, adding that it believed a switch to Wall Street would not boost its share price ‘at this point in time’.

The mining group’s boss Gary Nagle said the ‘unlikely’ chance the firm would be added to the S&P 500 index of top US-listed firms had also been a key factor.

‘You can be one of the 500 biggest companies but not in the S&P 500,’ Nagle said, adding that unlike the process for joining the FTSE 100, which is based on market value, the process for joining the US index was more ‘opaque’.

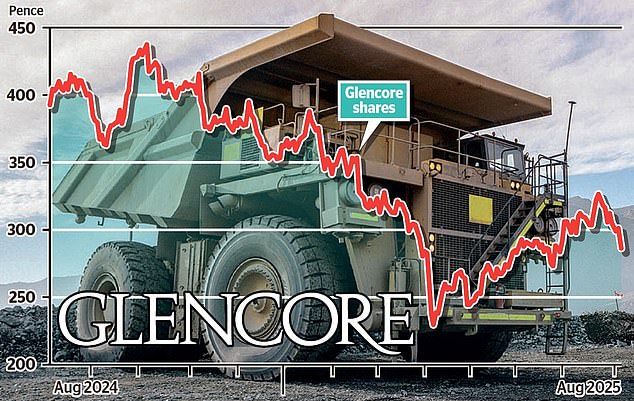

Relief: Glencore said it had shelved plans to move its main listing to New York, adding that it believed a switch to Wall Street would not boost its share price

He said this uncertainty was ‘a bigger issue’ than the ‘substantial’ costs Glencore would incur if it did move across the Atlantic.

‘London is where we are happy,’ Nagle said, although he added that the firm would ‘continue to review’ its listing situation.

The decision to stay put was a welcome relief to the London Stock Exchange (LSE), which has been hit by high-profile defections.

Paddy Power owner Flutter, construction equipment group Ashtead and money transfer group Wise have all quit in recent months.

There are also lingering fears that drugmaker AstraZeneca, the LSE’s largest company with a value of £174billion, could also be eyeing an exit following reports its boss Pascal Soriot is privately supportive of a move to the US.

Meanwhile, rival London-listed miner Rio Tinto is under pressure from shareholders to move its main listing to Sydney.

The decision to keep its London listing came as Glencore posted a £492million loss for the first half of the year, widening from a £175million loss in 2024, as its business was hit by lower production from its mines and a drop in commodity prices on global markets.

Revenues were mostly flat at £88.2billion.

It has been weighed down by weak prices of coal – as the largest western producer of the fossil fuel – lower output of copper, and shrinking earnings from its energy trading arm.

In a bid to revive profits, the firm plans to slash £750million in costs by the end of next year by reducing staff and contractor numbers.

But yesterday the shares dropped 5.4 per cent, or 16.3p, to 284.75p following the figures.

AJ Bell’s head of financial analysis Danni Hewson said weak results may have encouraged it to stay put in London.

‘It may be good news for the London market. However, rather than being a ringing endorsement of the merits of a UK listing, it may instead reflect the fact the company is not exactly in the best place to appeal to a new investor base elsewhere,’ she said.

AJ Bell’s head of financial analysis Danni Hewson said weak results may have encouraged it to stay put in London.

‘It may be good news for the London market. However, rather than being a ringing endorsement of the merits of a UK listing, it may instead reflect the fact the company is not exactly in the best place to appeal to a new investor base elsewhere,’ she said.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .