- Long-term Government borrowing costs have soared over the last year

- It comes as the BoE prepares to adjust its quantitative tightening approach

Its historic, knife-edge decision to cut interest rates captured headlines on Thursday, but the Bank of England could be about to make a far more consequential decision.

Two rounds of voting and a narrow 5-4 decision to cut base rate by 25 basis points to 4 per cent underlined the dilemma facing the central bank, as it attempts to balance the UK’s deteriorating economic performance with the potential for higher inflation.

And it comes just as the BoE navigates arguably the most important period for monetary policy since failing banks were bailed out in the wake of the global financial crisis.

In 2009, the BoE and other major central banks were forced to step in and buy hundreds of billions of pounds worth of government bonds amid fears of a total financial collapse.

The process, known as quantitative easing (QE), effectively lowered long-term borrowing costs to support the economy and keep inflation down.

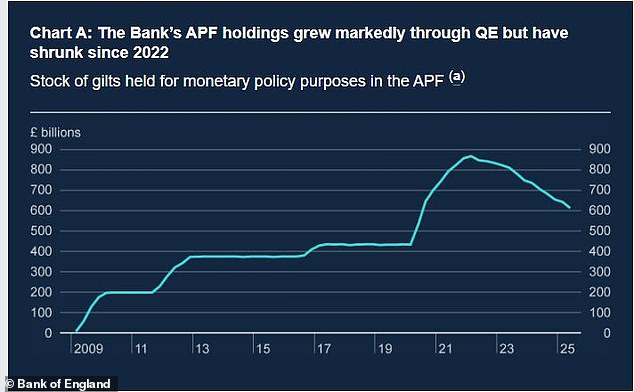

Stockpile: The BoE’s gilt holdings peaked at £875billion by 2022

The BoE would be forced to step in again with multiple rounds of QE during the eurozone crisis, the aftermath of Brexit and the pandemic, driving its gilt holdings to a peak of £875billion by 2022.

But the bank is now unwinding its gilt holdings in a process known as quantitative tightening (QT), piling further pressure on long-term government borrowing costs.

And 30-year gilt yields – the interest paid on government debt – have rocketed 85 basis points to 5.36 per cent over the last 12 months, while 10-year yields are up 60bps to 4.55 per cent.

Yields, which move inversely to the price of a bond, largely reflect expectations for inflation – and therefore long-term interest rates – but it means the BoE is effectively selling into a market short on enthusiastic buyers.

This is compounded by new gilts coming into issuance to help pay for the Government’s spending priorities.

Long-term government borrowing costs matter not just for the country’s ability to finance it debts, but because they have a strong influence on mortgage rates.

Slowing pace of QT ‘unavoidable’

On Thursday, the BoE said measuring the impact of QT on long-term gilt yields was challenging but estimated it was responsible for 15 to 25bps of growth, slightly higher than previous measurements.

Georgina Hamilton, fund manager for the Polar Capital UK Value Opportunities Fund, said: ‘The Bank’s annual QT review moderately increased the impact of QT of UK gilt yields paving the way for a possible reduction of the pace of QT from £100billion to £60billion at the September vote.

‘The BoE is taking a more aggressive approach that other major central banks in actively selling its bond holdings rather ran letting them mature passively. A softening of this approach should be help loosen tight long term credit conditions.’

The bank’s gilt stockpile is now expected to stand at £558billion by September 2025 after a planned £100billion of QT since October last year.

But analysts at UBS said the first £100billion was ‘easy’ as it included £87billion of redemptions, which are passive and have a less intense market impact than sales.

‘Passive’ QT is expected to drop by £35billion next year and ‘increasing active QT by that much is not an option’, UBS warned.

It added: ‘Maintaining a QT target of £100billion would imply an increase in active QT from £9.3billion to £47.3billion.

‘A step up of that size would likely be expected to have an unacceptable market impact.

‘Looking ahead, passive QT slows further to around £40billion for several years. Tapering QT to limit the impact of active sales seems unavoidable.’

ING analysts Padhraic Garvey and Michiel Tukker said there are other options for the BoE, but warned the outlook for UK borrowing costs would remain challenging.

They wrote in a note: ‘With plenty of liquidity still in the system, another way of addressing the concerns is by shortening the maturity of the bonds that are being sold.

‘Whilst we think such solutions could help in the near term, the fact remains that the UK faces serious fiscal challenges and upward pressures on longer rates are a global phenomenon. Any such tweaks would not address the more (global) structural challenges faced by gilts.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .