Rachel Reeves suffered a fresh headache after OECD forecasts underlined Britain’s deepening cost of living crisis – with the highest inflation in the G7 – and sluggish economic growth.

The report is likely to raise fears of stagflation – where the economy stagnates at the same time as inflation drives spiralling prices.

It comes as the Chancellor comes under mounting pressure ahead of November’s Autumn Budget as she seeks to fill a black hole of up to £50 billion in the public finances.

Separately, a closely-watched business survey – the purchasing managers’ index – pointed to a sharp slowdown in growth this month.

What is the forecast for the UK economy?

The Paris-based Organisation for Economic Cooperation and Development (OECD) predicts that the UK economy will grow by 1.4 per cent this year – a slight upgrade.

For 2026, the OECD continues to forecast meagre 1 per cent growth.

It will be a worry for Ms Reeves if the independent Office for Budget Responsibility (OBR) is equally pessimistic in November’s Budget. In the spring, it predicted growth of 1.9 per cent for 2026.

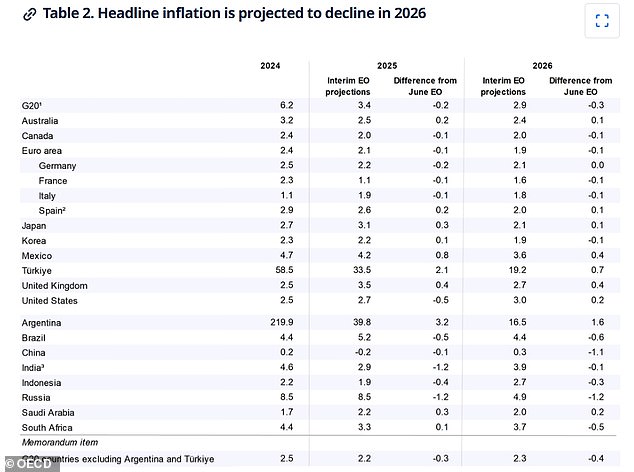

The outlook for UK inflation has been sharply upgraded for this year, from 3.1 per cent to 3.5 per cent, and for next, from 2.3 per cent to 2.7 per cent.

The Chancellor said: ‘These figures confirm that the British economy is stronger than forecast – it has been the fastest growing of any G7 economy in the first half of the year.

‘But I know there is more to do to build an economy that works for working people – and rewards working people.’

What’s going on with inflation?

The OECD report confirms Britain’s deepening cost of living problem. It cites the UK as one of a number of countries particularly badly hit by food inflation – adding to the pain faced by households doing the weekly shop.

The forecast means UK continues to face the highest inflation in the G7 this year – though will fall behind the US in 2026.

Shadow Chancellor Sir Mel Stride said: ‘The OECD confirms what hard-working families already feel – under Labour, Britain is in a high tax, high inflation, low growth doom loop.

‘Rachel Reeves seems to think the solution is yet more tax rises. The UK is now teetering on the edge of stagflation, all driven by Labour’s economic mismanagement.

‘This should be a wake-up call to the Chancellor: you can’t tax your way to growth.”

What is stagflation and are we at risk?

Stagflation is the term given to the toxic combination of high inflation and stagnant growth.

The Chancellor and the Bank of England are facing an environment of weaker economic output and above-target inflation.

This was underscored by a closely-watched survey from S&P Global on Tuesday that showed private sector output has slowed to its weakest level since May as higher business costs have sparked ‘subdued’ demand and further job cuts.

The most recent data from the Office for National Statistics shows the UK economy grew by 0.2 per cent in the three months to July, slowing from growth rates of 0.3 and 0.6 per cent in the three months to June and May respectively.

Meanwhile, consumer prices index inflation was 3.8 per cent in August, almost double the BoE’s target of 2 per cent. Inflation is expected to peak this month or next.

Inflation in the UK is considerably higher than the 2.9 per cent level in the US, where growth is at 2.1 per cent. Across the eurozone inflation is 2.1 per cent and GDP growth is 1.5 per cent.

Market concerns over inflation in the UK, the size of our borrowing and the lack of growth to pay for it, have led to longer-term gilt yields rising, with 30-year gilts topping 5.5 per cent in recent weeks.

What next for interest rates?

The BoE currently appears to be more concerned about inflation than slowing growth, so markets are not expecting any more interest rate cuts this year. The base rate was kept on hold at 4 per cent last week.

The OECD, however, said it expects a ‘gradual easing’ of UK policy rates next year.

Could things be better than they seem?

There is evidence of UK consumer resilience, with retail sales outpacing global peers.

Martin Beck, chief economist at WPI Strategy, thinks the OECD’s outlook for the UK may prove ‘too pessimistic’.

He said: ‘Inflation and interest rates should both be lower next year, while the UK will also gain from spillovers from looser macroeconomic policy in the US and Europe.

‘And with memories of the shocks of recent years fading and another round of damaging speculation about tax rises hopefully avoided, households may feel more confident about drawing on their savings.’

How does the UK compare to its rivals?

While growth at home is not shooting the lights out, the UK is still on track to trail only the US in GDP output this year, according to the OECD, which is predicting weaker growth, further job losses and high cost pressures for many economies.

The OECD expects global GDP growth to slow from 3.3 per cent last year to 3.2 per cent in 2025, before falling to 2.9 per cent in 2026.

It warned the waning effect of ‘front-loading’ ahead of US trade tariffs, combined with higher tariff costs feeding through to prices, and ‘still-high policy uncertainty’ would ‘dampen investment and trade’ in the months and years ahead.

But aggregate consumer price inflation is expected to fall among G20 countries as a result of slower economic growth and weaker jobs markets.

The UK is among outliers Canada and the US among advanced economies in that wage growth has not yet sufficiently moderated.

The OECD warned this would not change ‘unless there are lasting improvements in labour productivity growth’.

US consumers, however, are set to suffer even greater cost pressures.

The OECD said: ‘In the United States, the increase in effective tariff rates will further boost inflation, with the rate of pass-through to final goods prices assumed to strengthen as businesses become less willing to absorb the rising cost of imported goods.’

The UK is set to see comparatively high levels of inflation as cost pressures ease elsewhere

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .