Colm Walsh, managing director of investment trust ICG Enterprise, says investors buy into his fund for ‘access to the real economy’.

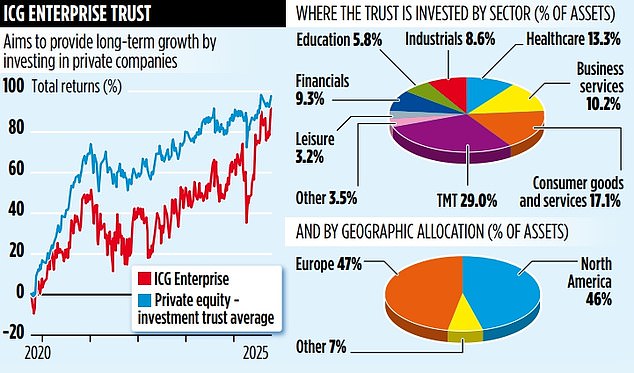

Buy a FTSE 100 tracker, he explains, and you’re getting mega cap banking stocks and oil, or buy into the S&P 500 and you’re getting AI. But ICG offers exposure to companies that shape their sectors – something that can be tricky for individual investors to get right.

Walsh’s ‘real economy’ fund covers everything from ice cream manufacturing – Haagen-Dazs producer Froneri – to West End venues – ATG Group, which owns the Lyceum Theatre in London.

Walsh says he picks businesses because they are market leaders in their niches and headquartered in developed markets.

That’s a broad brief. But the main thing these companies have in common, from investors’ point of view, is they are all buyouts – firms taken on by private equity and being run with a view to selling them or floating them on the stock market at a profit.

ICG Enterprise takes stakes in a variety of ways. These involve investing in funds run by private equity companies themselves, including its own manager, Intermediate Capital Group, and taking direct shares in companies alongside big private equity funds.

Some of its investments are ‘primaries’ – they’ve taken the stake in the private equity fund during an initial fundraise – while a smaller number are ‘secondaries’, where it acquires already mature funds from other investors.

There are several reasons why investors might want a private equity fund such as ICG’s.

The main one is that, like Heineken’s famous advert, they refresh parts of your portfolio that other funds can’t reach.

Many of the most exciting companies in the world aren’t on the stock market for individuals to buy at present, and traditionally only institutional investors have been able to get at them.

But as an investment trust, ICG Enterprise has stock market-listed shares that you can buy and sell whenever you like, despite the illiquid nature of its underlying assets.

ICG’s shares trade at a 26 per cent discount to its net asset value (NAV), meaning you can buy in for less than the sum of its parts. This sounds like a bargain, but it is slightly more expensive than some of its private equity peers.

But last week’s half-year results justified the premium, as the fund showed that it is doing well at ‘exiting’ its investments – which is a private equity way of saying that it sold its stakes for cash. Analysts that cover the investment trust, such as Barclays’ Conor Finn, says this ability to exit at a profit helps to justify the price of the shares.

The rest of ICG’s figures were more pedestrian. The portfolio itself grew by only 2.1 per cent, and much of this was wiped out by currency fluctuations. Almost half of the company’s investments are in the US, and the weakness of the dollar dented returns.

ICG Enterprise does have a track record of returning cash, though – both through buybacks and dividends. Finn believes it will return 6 per cent of its net asset value to shareholders this year, which as the NAV is £20.40 equates to around £1.22 a share.

Rather like eating the Haagen-Dazs that ICG Enterprise invests in, you should only hold a fund like this as part of a balanced diet – alongside a diversified portfolio of equities and bonds – but as a way of getting exposure to private assets, it is worth taking a scoop.

ICG has ongoing charges of 1.38 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .